If retirement is on the horizon, now’s the time to start thinking about your next chapter. And you probably want to make sure you’re set up to feel comfortable financially to live the life you want in retirement.

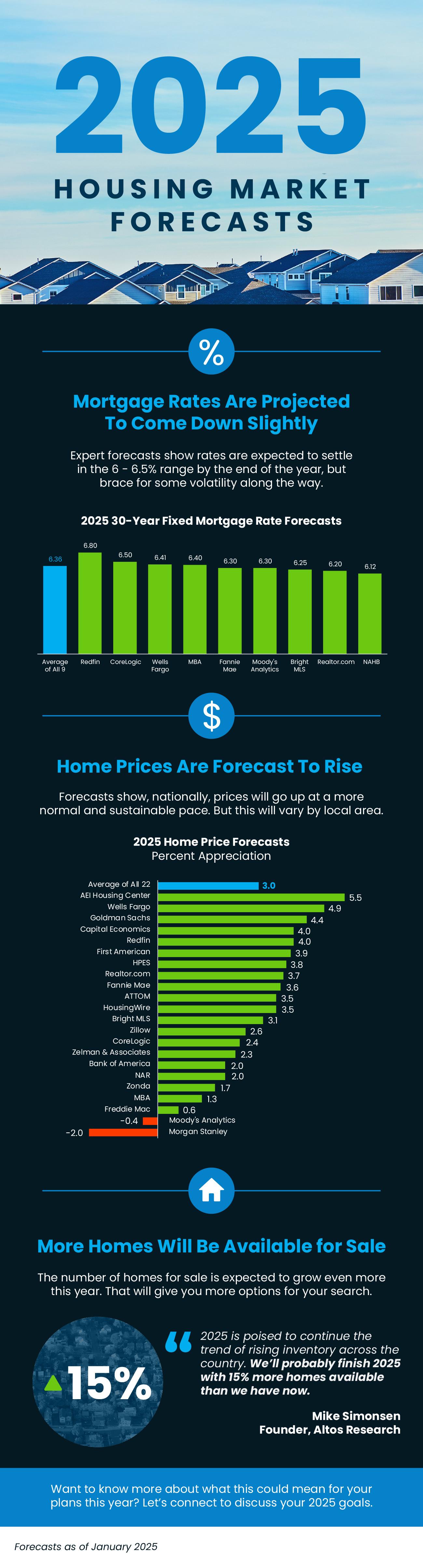

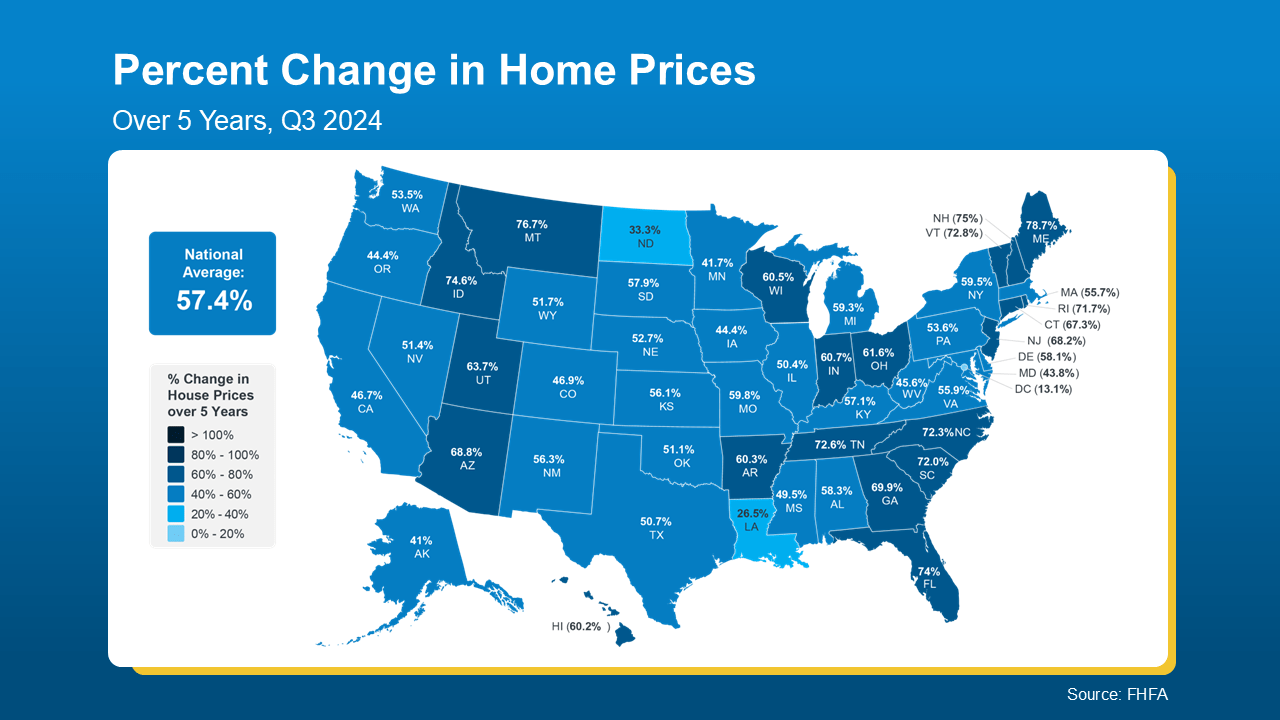

What you may not realize is you likely have a hidden goldmine of cash you’re not thinking about — and that’s your home. Data from the Federal Housing Finance Agency (FHFA) shows that home values have gone up nearly 60% over the last 5 years alone (see graph below):

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

“ . . . Boomer overall wealth increased by $19 trillion, or $486,000 per household, half of which is due to house price appreciation.”

So if you’ve been in your house ever longer than that, chances are you have even more equity in your home. If you want to have access to more of the wealth you’ve built up throughout the years, it’s worth thinking about selling your house to downsize.

Why Downsizing Might Be the Right Move

Selling now so you can downsize into a smaller home, or maybe one in a more affordable area, could free up your home equity so you can use a portion of it to help you feel confident retiring. Whether you want to travel, spend more time with family, or just feel financially secure, accessing the equity in your home can make a huge difference. As Chase says:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Here are just a few of the ways a smaller home can fuel your retirement:

1. Cut Your Cost of Living

Data from the AARP shows the number one reason adults 50 and older move is to reduce their cost of living. Downsizing to a smaller house or relocating to a more affordable area can help you lower your monthly expenses — like utilities, property taxes, and maintenance costs.

2. Simplify Your Life

A smaller home often means less upkeep and fewer responsibilities. That can free up your time and energy to focus on the things that matter most in your retirement.

3. Boost Your Financial Flexibility

Selling your current house gives you access to your equity, turning it into cash you can use however you like. Whether it’s investing, paying off debt, or creating a financial cushion, it can open up new opportunities for your future.

The First Step Toward Your Next Chapter

If you think you may be interested in downsizing, working with a real estate agent is your next step. Your agent will help you understand how much equity to have and how you can use it. But they’ll do more than that. They’ll also help you navigate the entire process of selling your current home and finding a new one, so you can transition smoothly into a new home and a new phase of life.

Bottom Line

If you’re planning to retire in 2025, now may be the perfect time to downsize and unlock the equity you’ve built up in your home. Connect with a local agent to start planning your move now, so you’re set up to make every day feel like a Saturday.

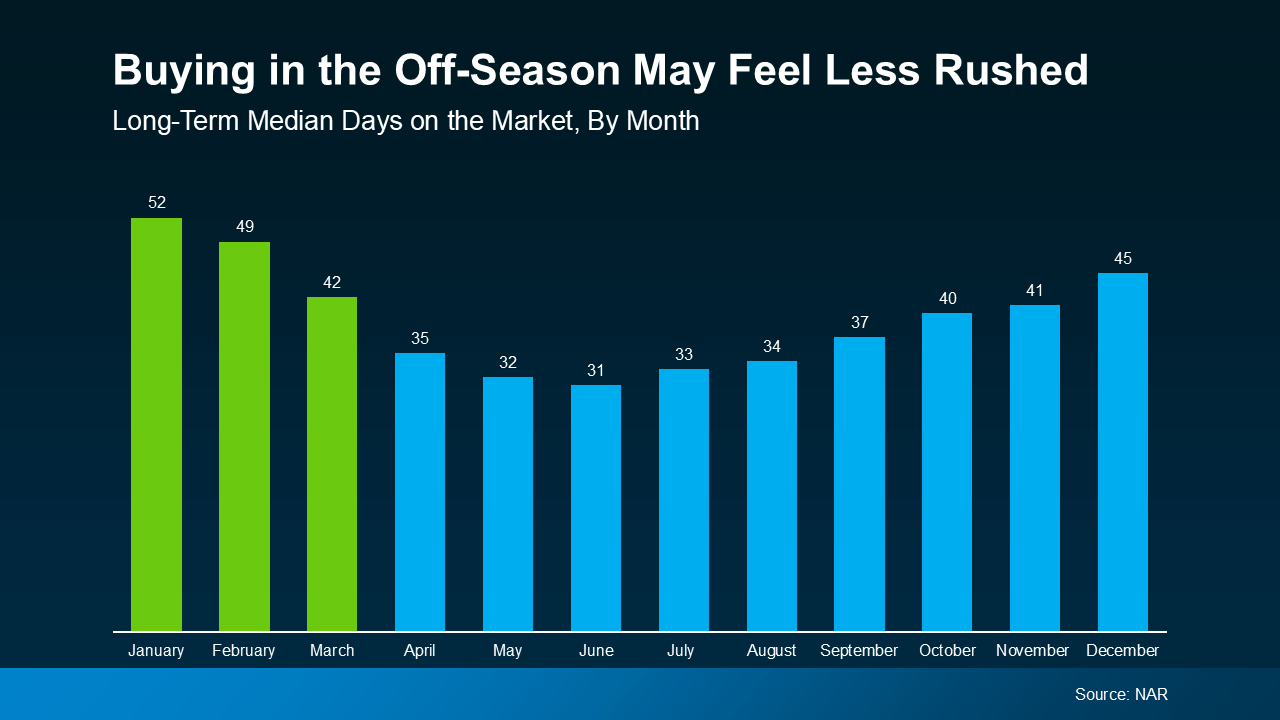

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

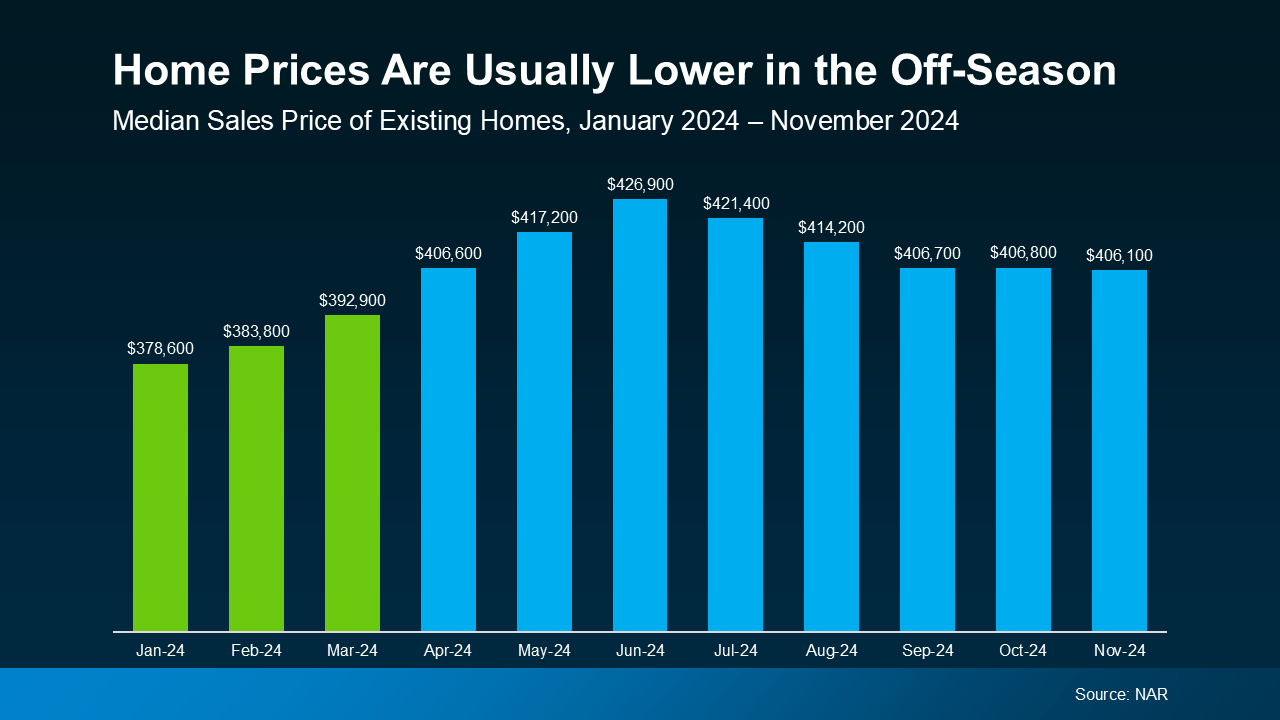

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors: This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

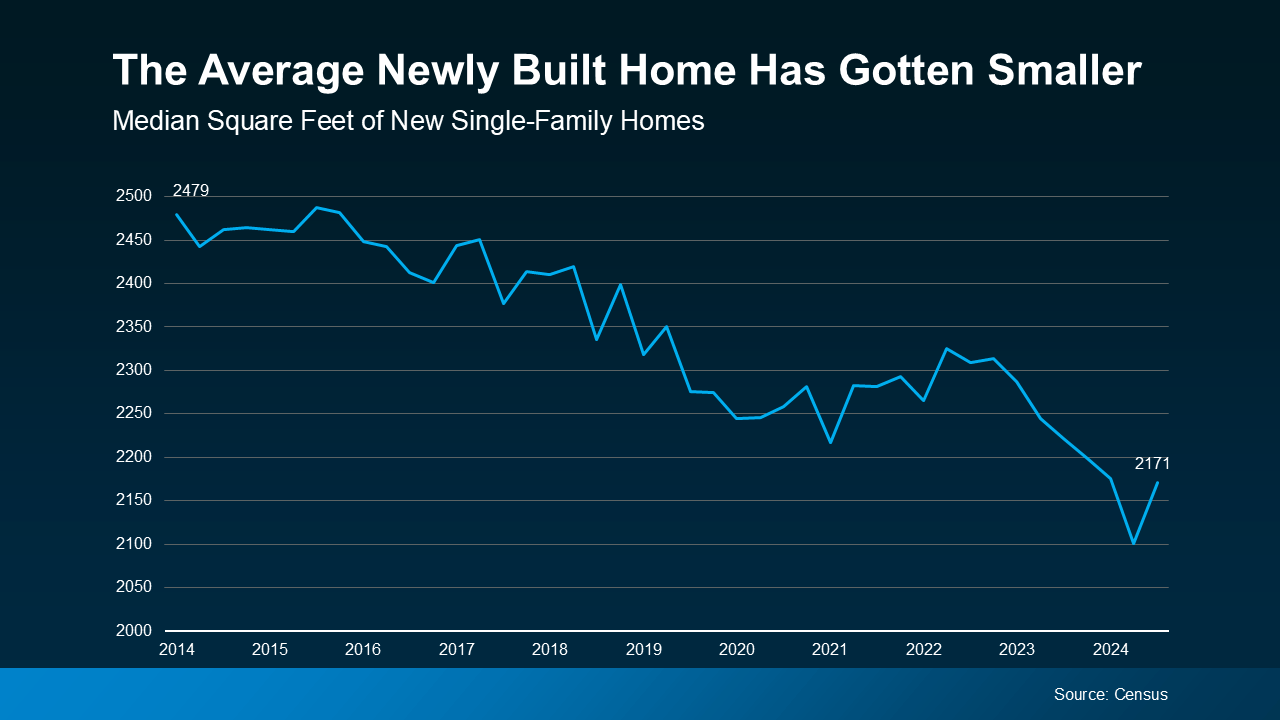

As the graph shows, the average size of a brand-new home has dropped from 2,309 square feet in Q3 2022 to 2,171 square feet in Q3 2024. That’s a difference of 138 square feet.

As the graph shows, the average size of a brand-new home has dropped from 2,309 square feet in Q3 2022 to 2,171 square feet in Q3 2024. That’s a difference of 138 square feet.

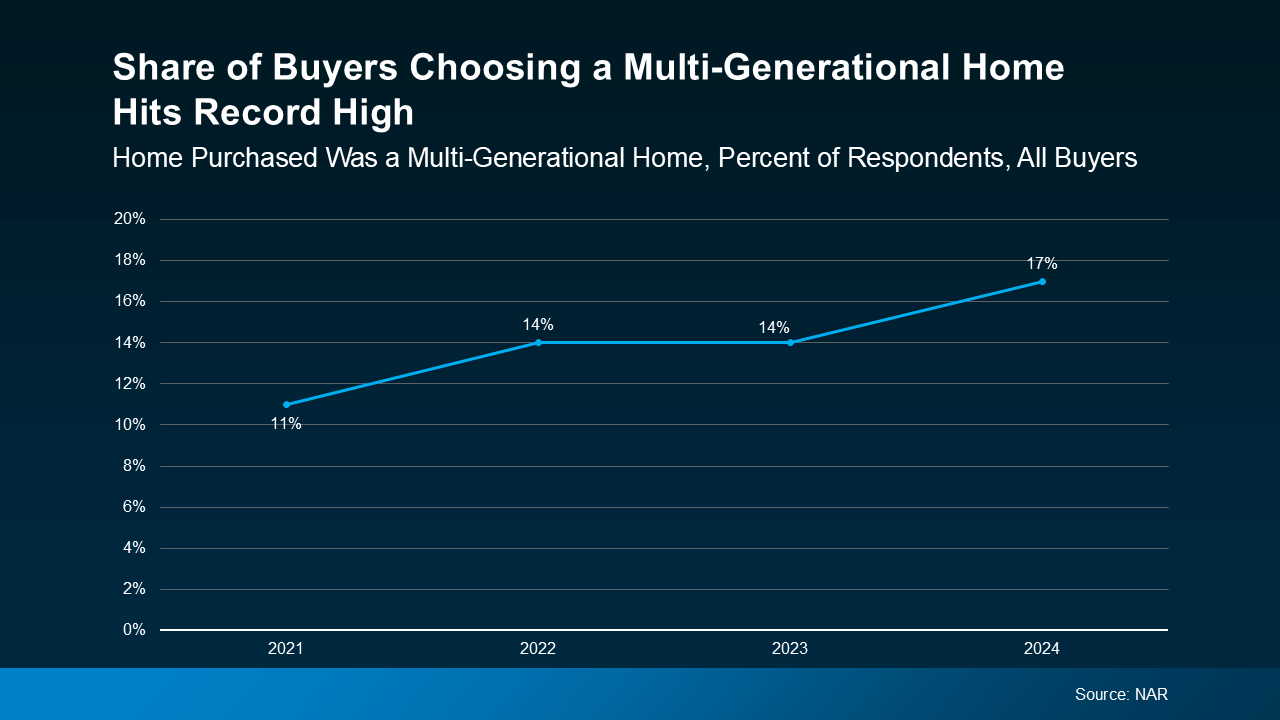

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home