In today’s digital age, it’s tempting to rely on automated tools for everything — including figuring out how much your house is worth. But be careful. The automated estimates you’re seeing online often miss key details that affect the true market value of your home.

Before you toss a for sale sign in your yard and expect to bring in the number you saw for your house online, you need to understand why these tools generally aren’t spot-on and why working with an expert real estate agent is the best way to get an accurate picture of what your house is really worth.

The Myth: Online Home Value Estimates Are Accurate

Online home valuation tools give you an approximate value for your house based on the data that’s publicly available for your home. While this can give you a rough starting point, the keyword here is rough. As an article from Ramsey Solutions says:

“Online Home Value Estimators Aren’t 100% Accurate . . . The estimates are only as reliable as the amount of public record data the real estate websites can access. The less data gathered for your particular neighborhood, county and state, the less you can depend on this number.”

The Reality: Online Estimates Miss Key Factors

Here’s the biggest issue with online estimates: they don’t take into account the unique aspects of your home or your local market. And that’s why an agent’s expertise can make such a difference when figuring out what your house is really worth. Here’s an example. A real estate agent will also factor in:

- The Home’s Condition: Online tools can’t tell whether your home has been well-maintained or if it needs significant repairs. The condition of your house plays a huge role in its value, and only an in-person walk-through can account for that.

- The Latest Neighborhood Trends: Is your neighborhood up-and-coming? Are there new developments or amenities nearby that make your home more desirable? Automated tools often overlook local trends that can significantly affect the value of your home.

- Accurate Comparable Sales: While online estimates may use past sales data as a baseline, they don’t always reflect the most recent or most relevant comparable sales, or comps. Real estate agents, on the other hand, have access to up-to-date market data and can give you a much more accurate estimate based on real-time sales in your area.

Agents have a deep understanding of the local market, and they can provide insights that automated tools simply can’t match. As Bankrate explains:

“Online estimation tools determine pricing using algorithms that rely on publicly available information. These algorithms can vary widely from one tool to the next and typically don’t account for a home’s current condition or any upgrades or renovations that are not reflected in public records. So they are not as accurate as in-person methods, like a real estate agent’s comparative market analysis . . .”

Bottom Line

While online home value estimates can be a helpful tool to get a rough idea of what your home is worth, they aren’t foolproof. The true value of your home depends on a range of factors that automated tools just can’t account for.

To get the most accurate estimate, work with a local real estate agent. That way you have expert guidance and up-to-date market insights to set the best possible price for your home.

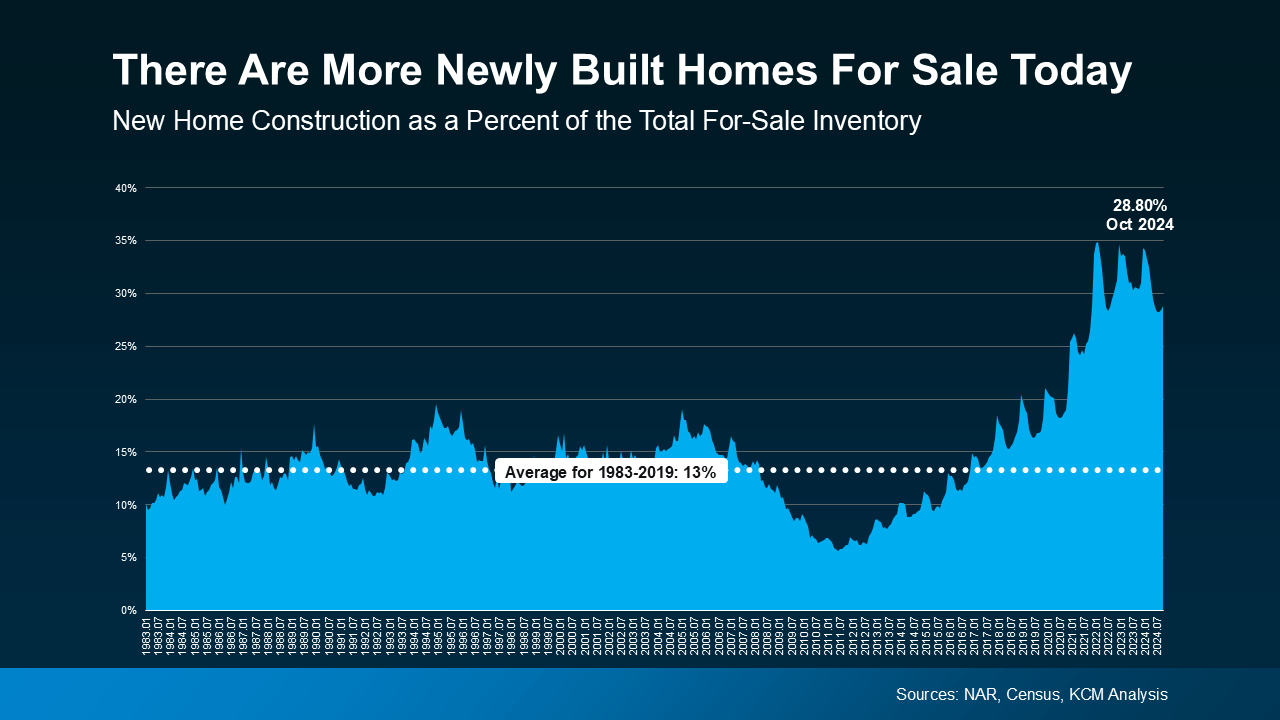

From 1983 to 2019, newly built homes made up only 13% of the total inventory of homes for sale. Today, that number has climbed to 28.8%, according to the most recent data.

From 1983 to 2019, newly built homes made up only 13% of the total inventory of homes for sale. Today, that number has climbed to 28.8%, according to the most recent data.

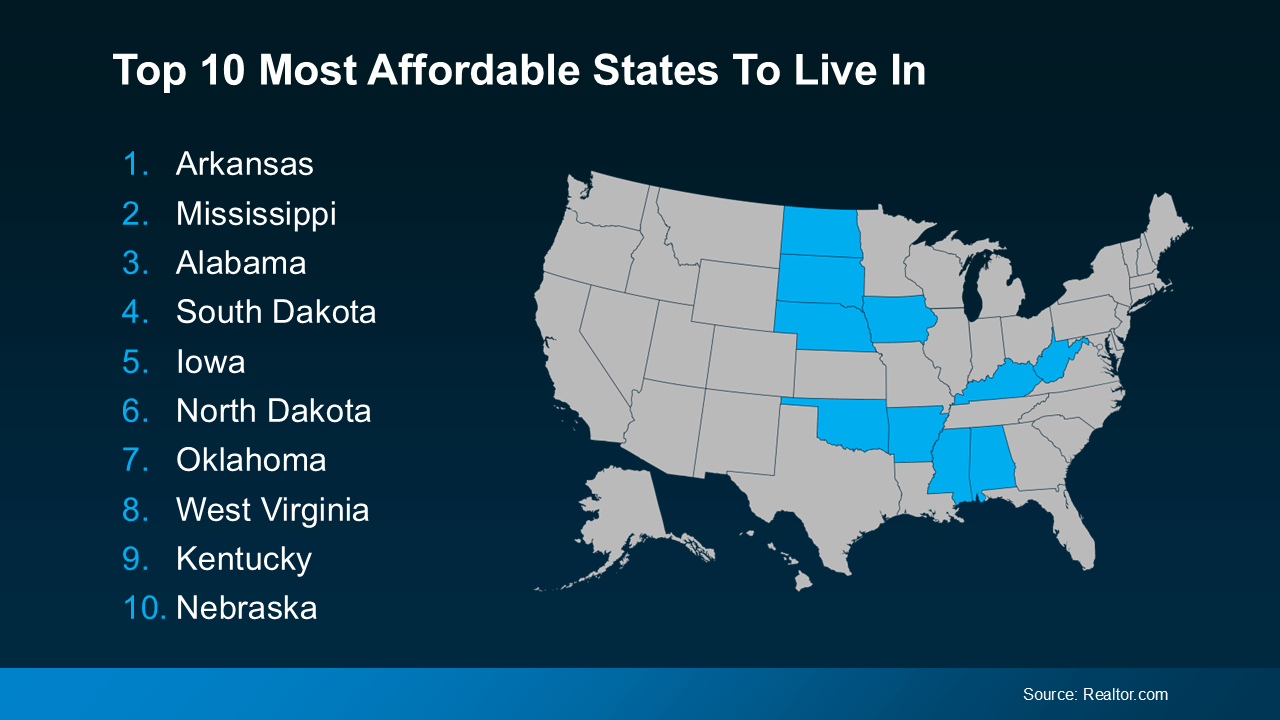

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you're open to relocating, you might discover the savings you’re looking for.

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you're open to relocating, you might discover the savings you’re looking for.

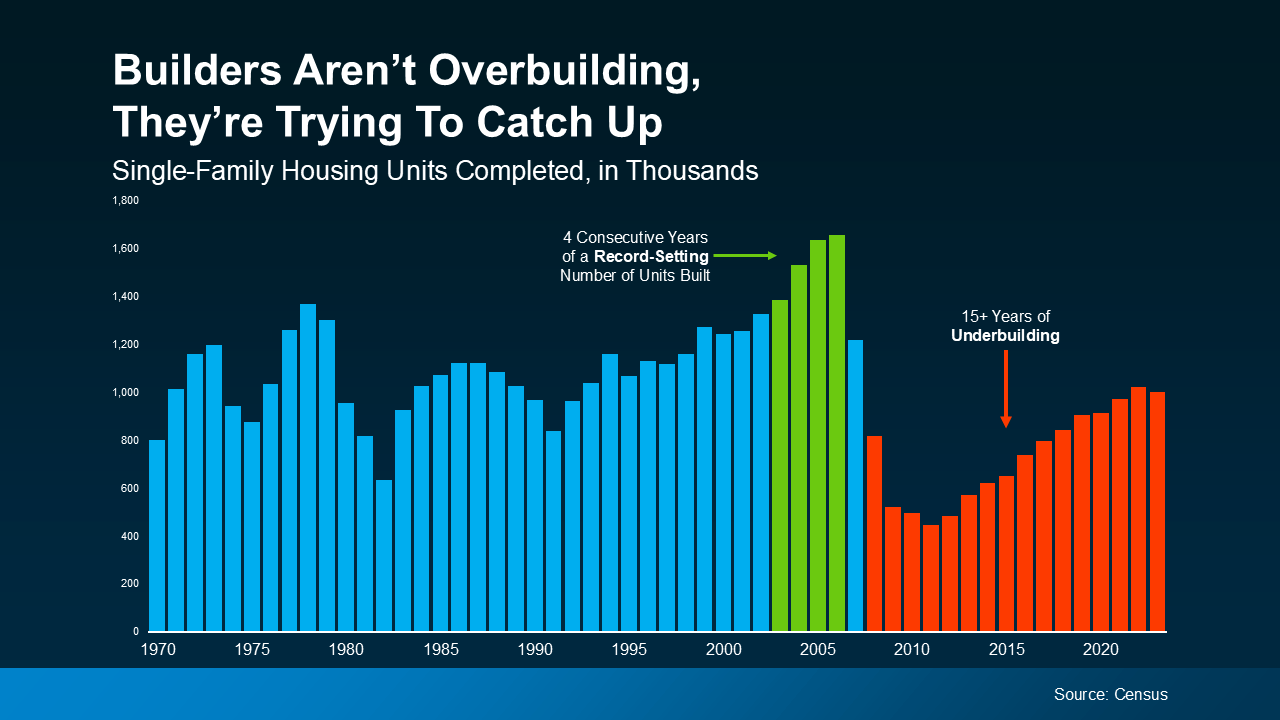

Even with new construction on the rise over the past few years, builders are playing catch-up. And according to AmericanProgress.org, they’re still not even keeping up with today’s demand, let alone making up for years of underbuilding.

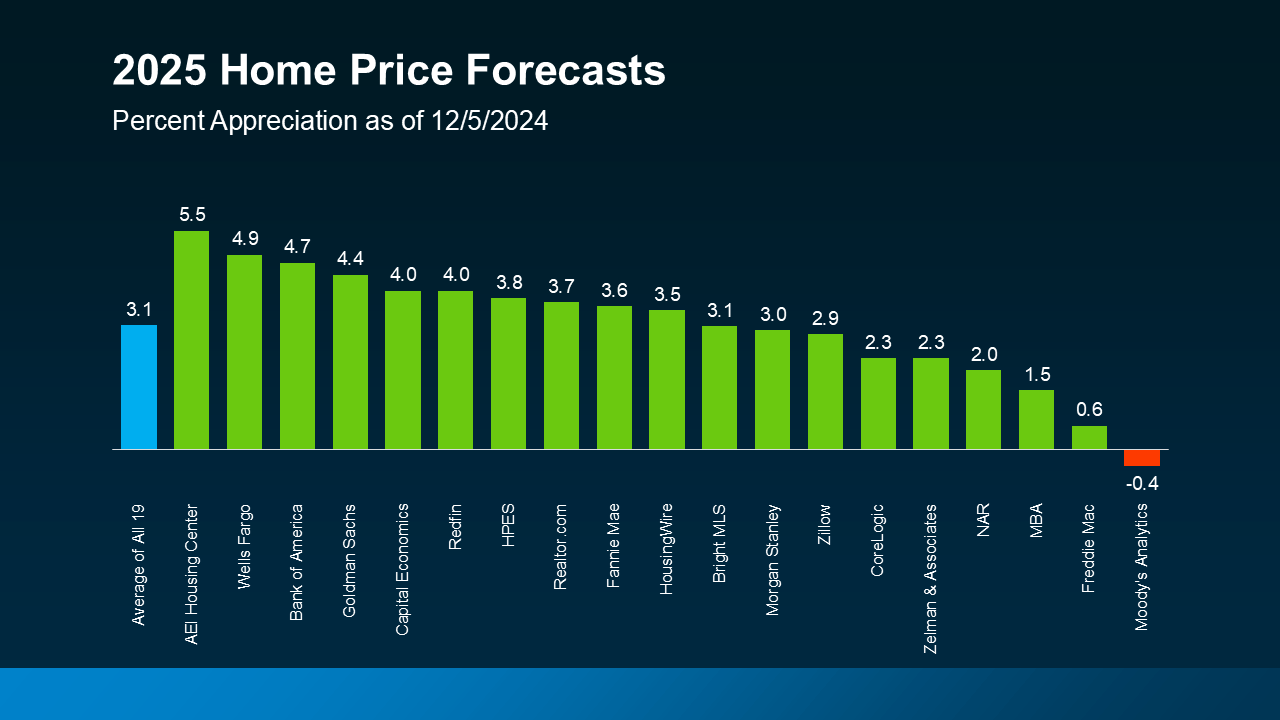

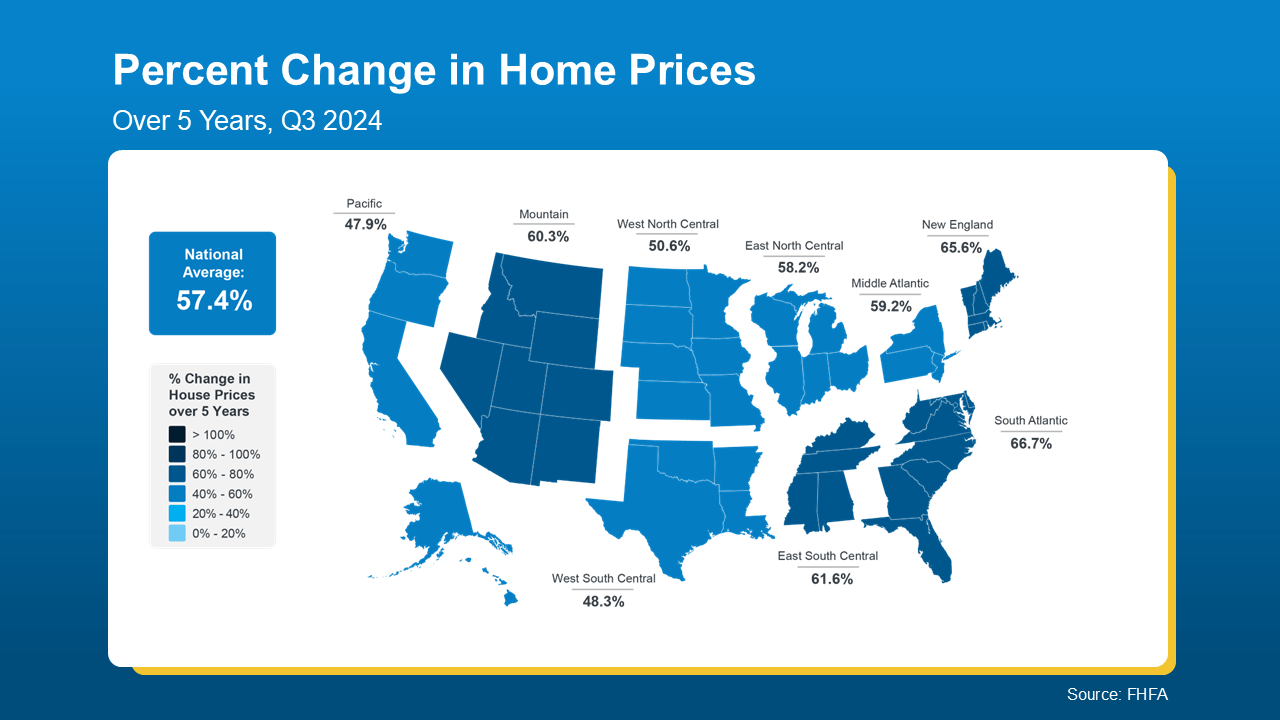

Even with new construction on the rise over the past few years, builders are playing catch-up. And according to AmericanProgress.org, they’re still not even keeping up with today’s demand, let alone making up for years of underbuilding. But it’s important to note home prices vary by market. What happens nationally might not reflect exactly what’s happening in your area. If your local market has more inventory available, prices could grow more slowly or even decline slightly. But in areas where inventory remains tight, prices will keep climbing – and that’s what’s happening throughout most of the country. That’s why it’s crucial to work with a local real estate expert who understands your market and can explain what’s going on where you live.

But it’s important to note home prices vary by market. What happens nationally might not reflect exactly what’s happening in your area. If your local market has more inventory available, prices could grow more slowly or even decline slightly. But in areas where inventory remains tight, prices will keep climbing – and that’s what’s happening throughout most of the country. That’s why it’s crucial to work with a local real estate expert who understands your market and can explain what’s going on where you live.

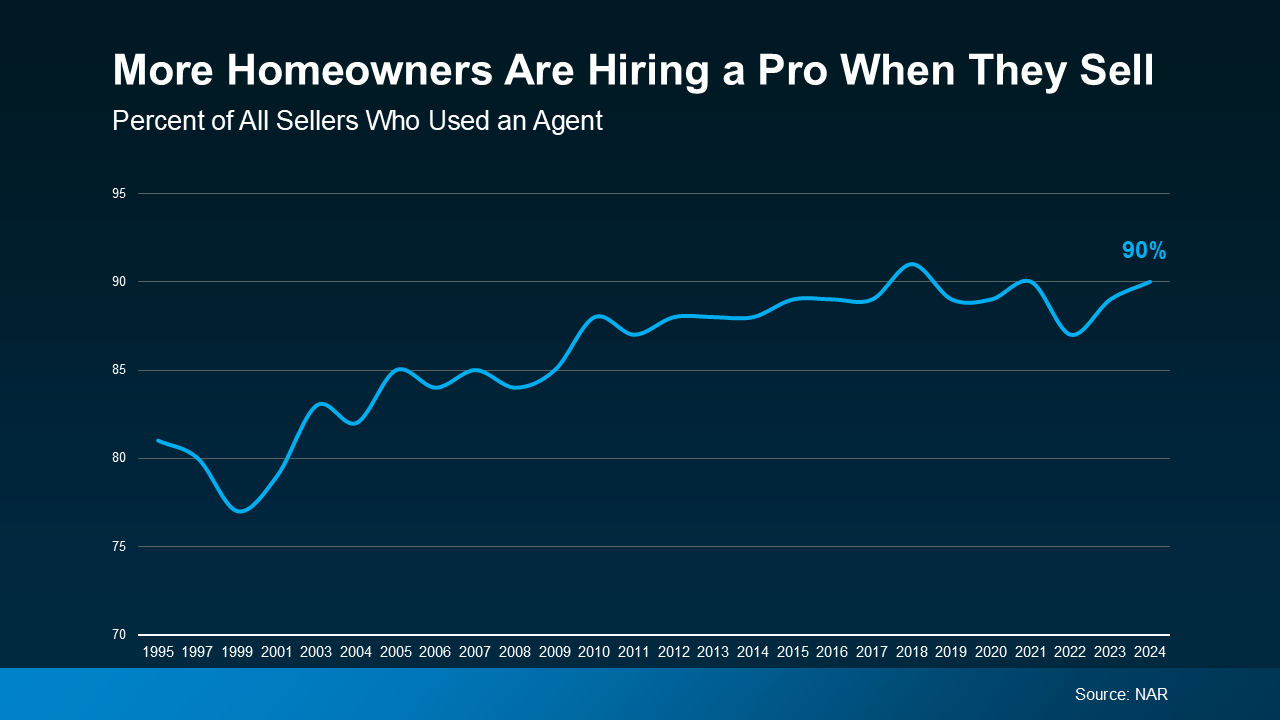

And here’s why partnering with an expert is the go-to choice. Selling your home is a big deal, and while FSBO might seem like a way to save time or money, it comes with a lot of responsibilities.

And here’s why partnering with an expert is the go-to choice. Selling your home is a big deal, and while FSBO might seem like a way to save time or money, it comes with a lot of responsibilities.

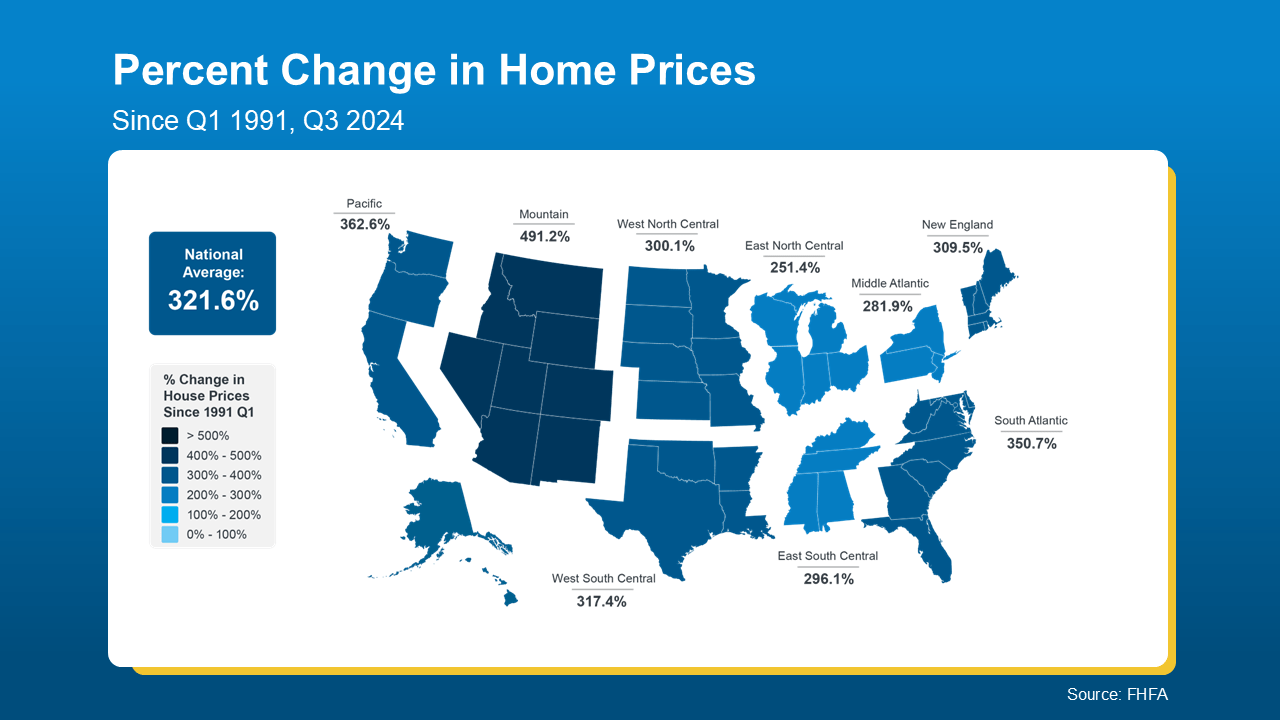

The second map shows that, over a roughly 30-year span, home prices appreciated by an average of more than 320% nationally.

The second map shows that, over a roughly 30-year span, home prices appreciated by an average of more than 320% nationally.

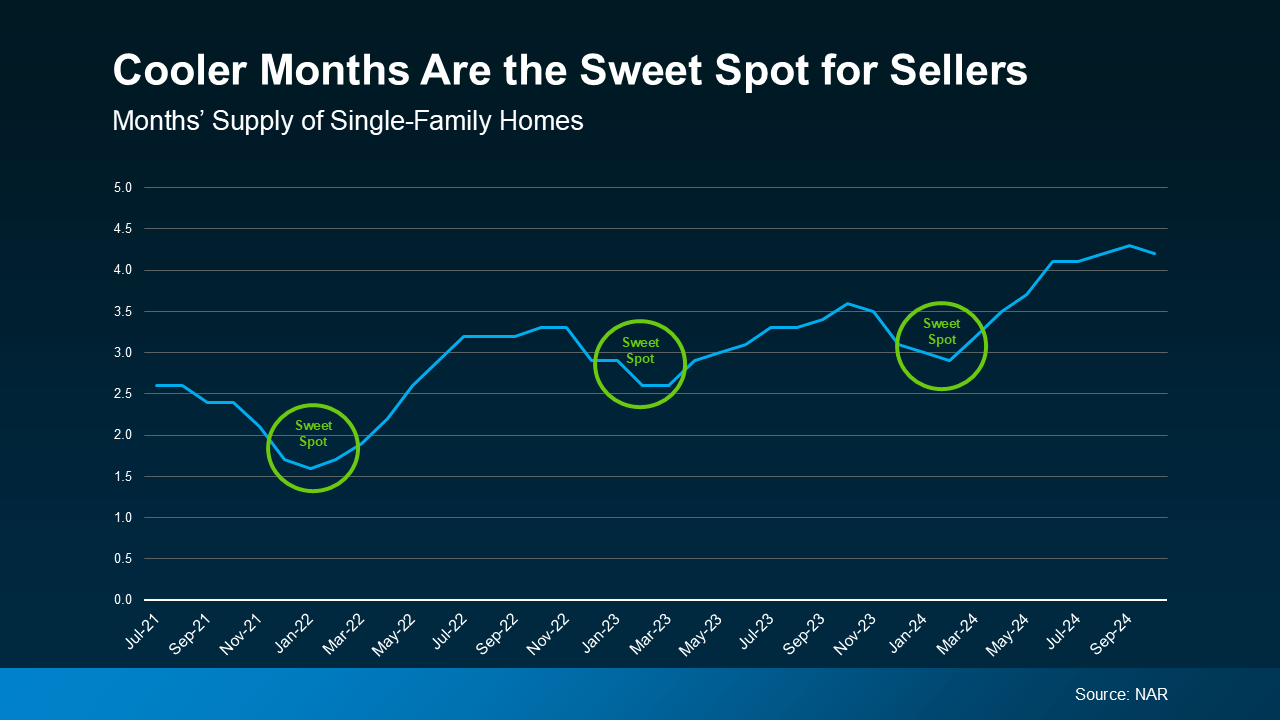

Here’s why knowing how this trend works gives you an edge. While inventory is higher this year than it‘s been in the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot. So, while other sellers are taking their homes off the market, you can sell before the spring wave of new listings hits, and your house will have a better chance of standing out.

Here’s why knowing how this trend works gives you an edge. While inventory is higher this year than it‘s been in the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot. So, while other sellers are taking their homes off the market, you can sell before the spring wave of new listings hits, and your house will have a better chance of standing out.

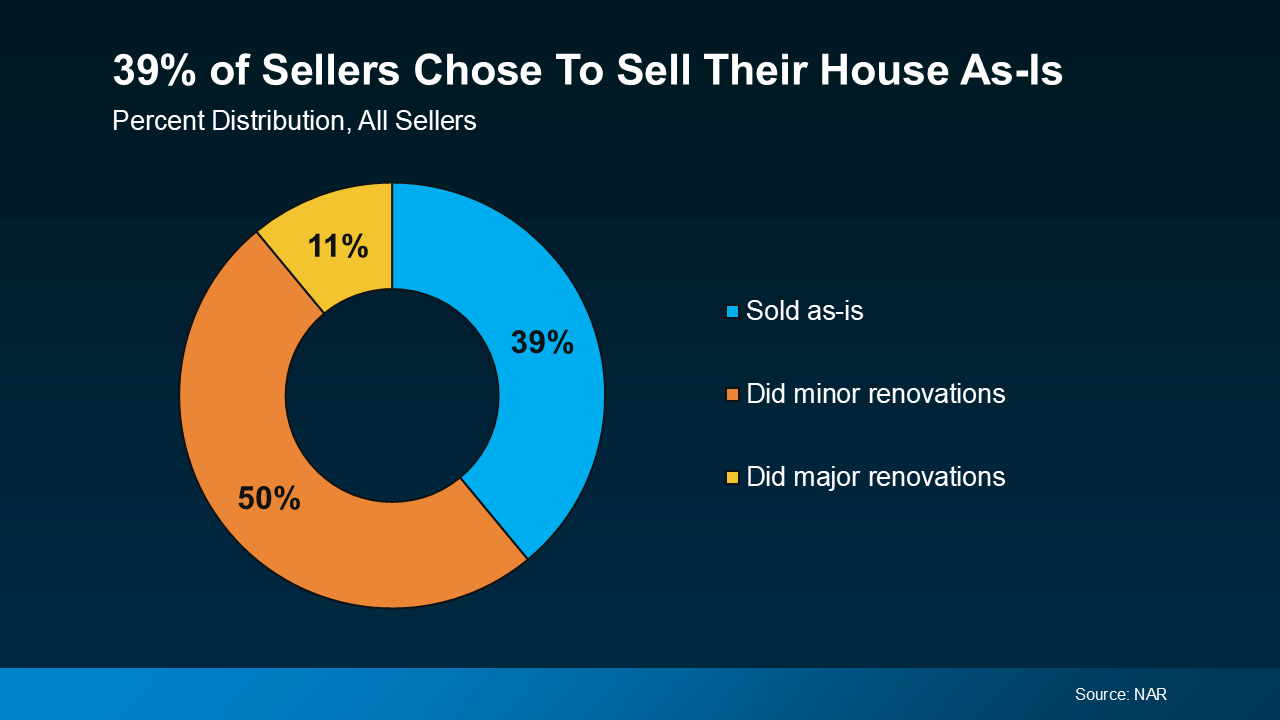

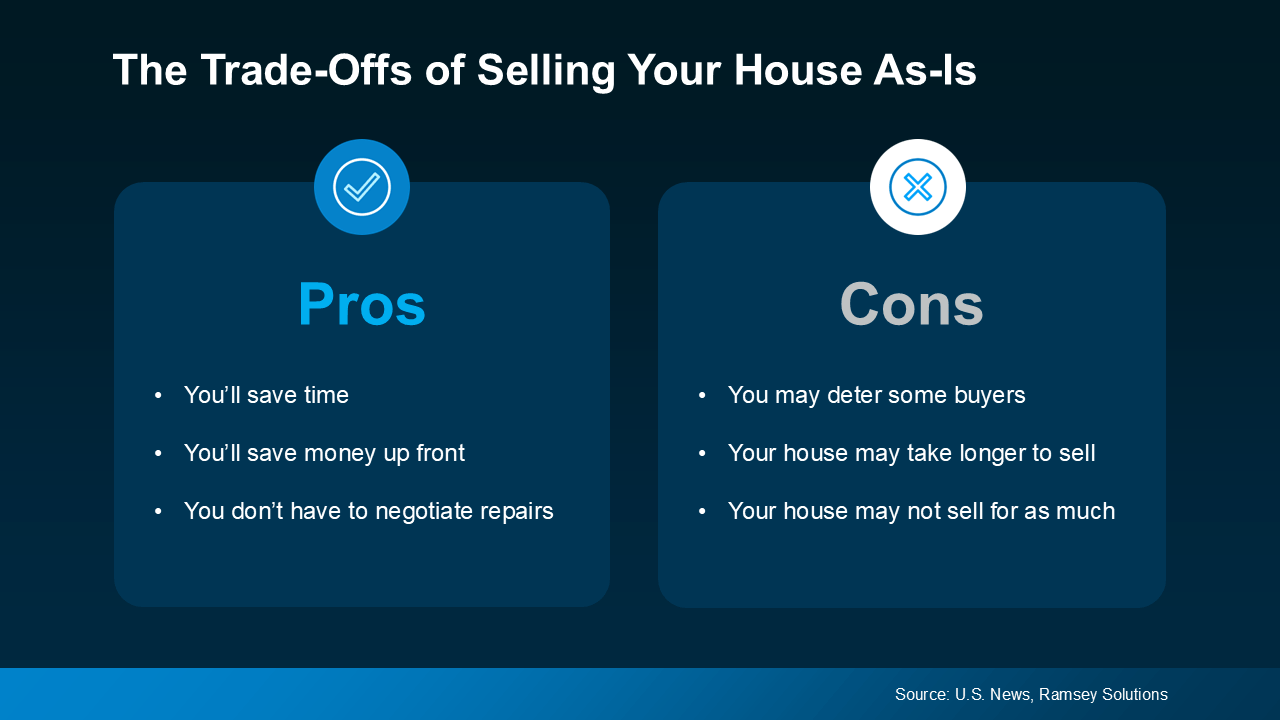

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know. Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.