![Myths About the 2024 Housing Market [INFOGRAPHIC] Simplifying The Market](https://terceroagency.com/wp-content/uploads/2024/04/Myths-About-the-2024-Housing-Market-KCM-Share.png)

Some Highlights

- When it comes to the current housing market, there are some myths circling around right now.

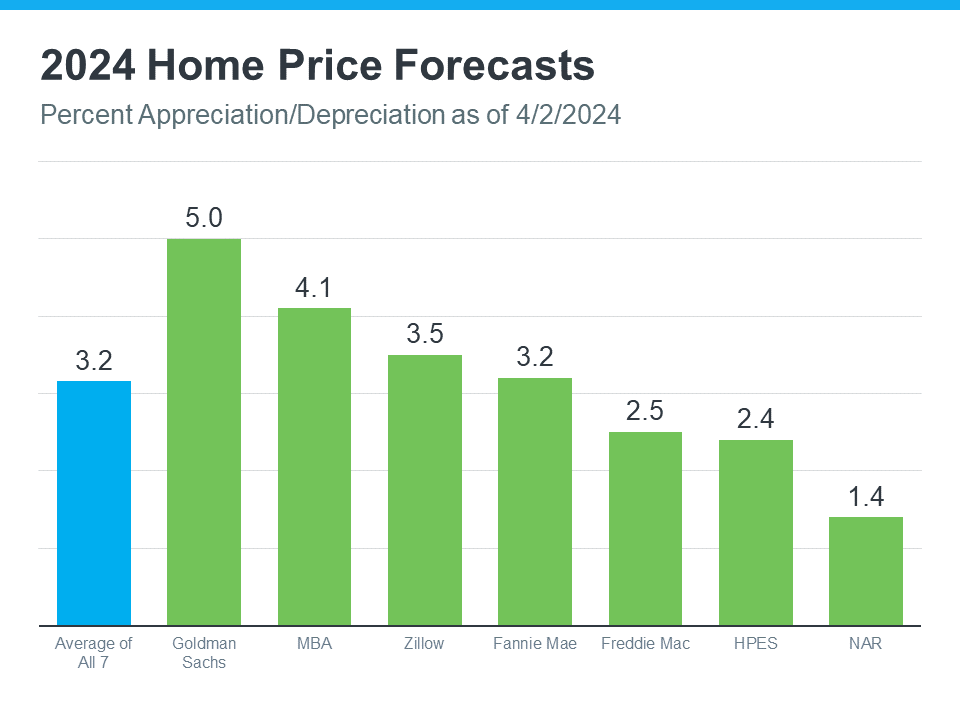

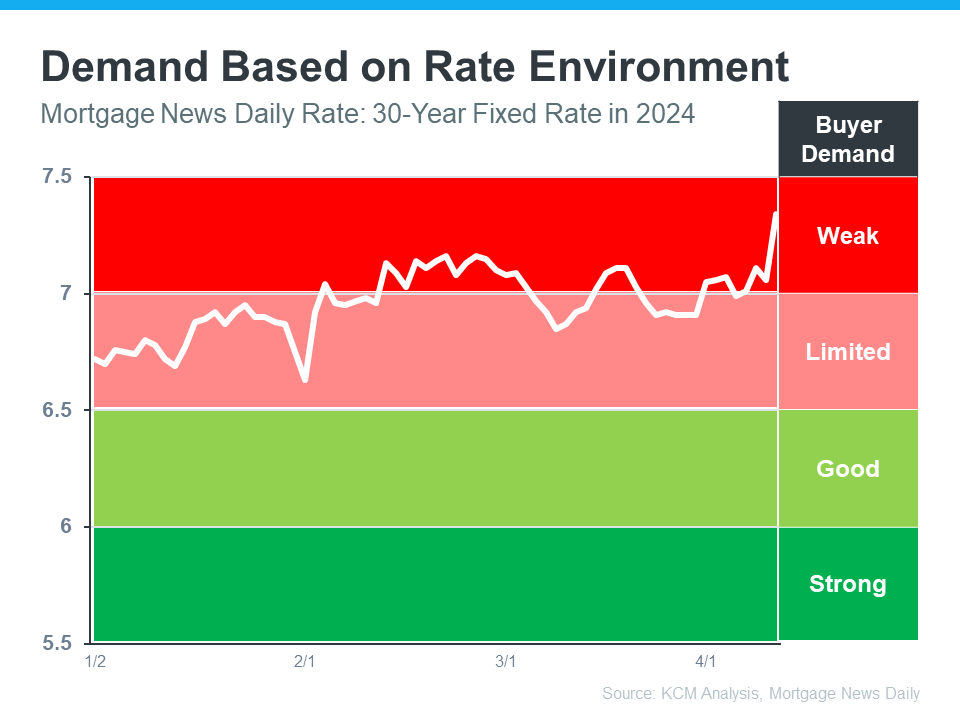

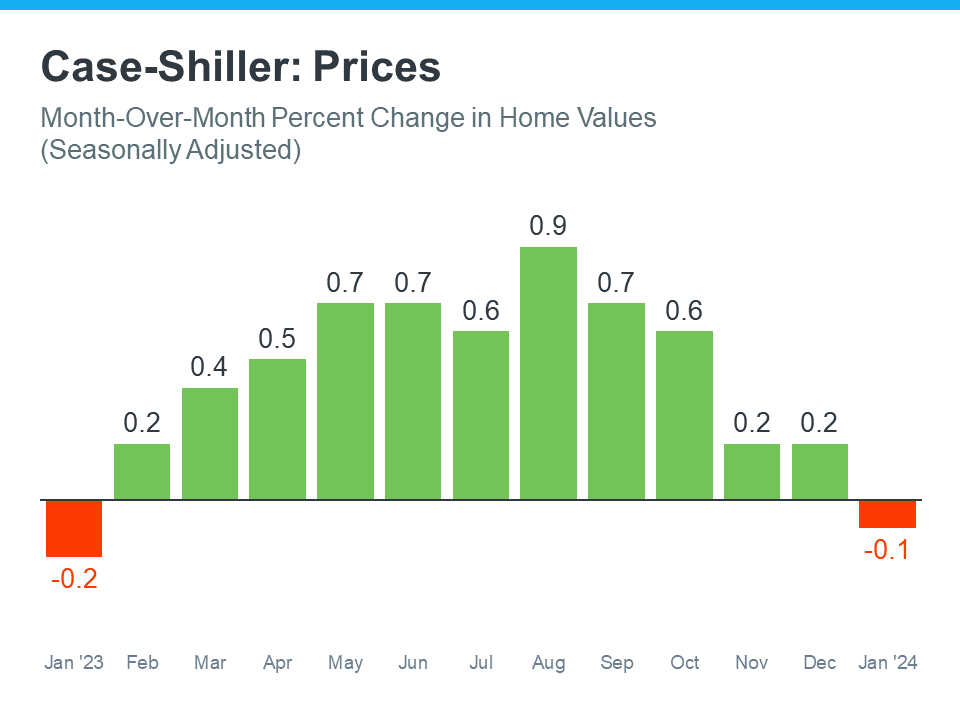

- Some of the more common ones are that it’s better to wait for mortgage rates to fall or prices to crash. But there are others about the supply of homes for sale and down payments.

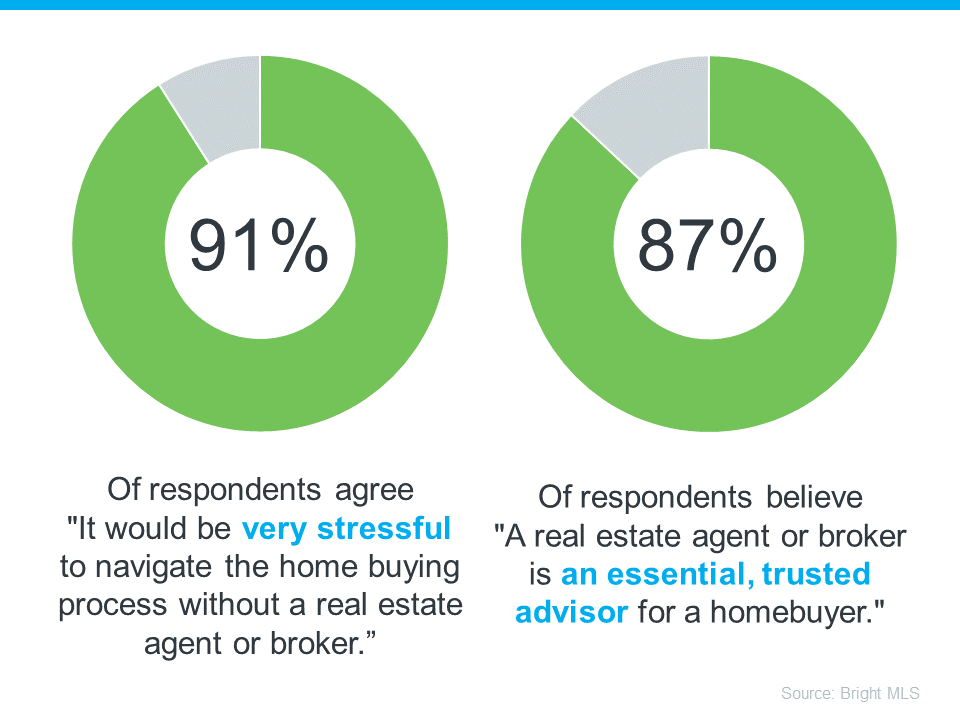

- Lean on a real estate professional to help separate fact from fiction in today’s housing market.

![The Perks of Downsizing When You Retire [INFOGRAPHIC] Simplifying The Market](https://terceroagency.com/wp-content/uploads/2024/04/The-Perks-of-Downsizing-When-You-Retire-KCM-Share.png)