![Real Estate Is Still the Best Long-Term Investment [INFOGRAPHIC] Simplifying The Market](https://terceroagency.com/wp-content/uploads/2024/06/Real-Estate-Is-Still-the-Best-Long-Term-Investment-KCM-Share-original.png)

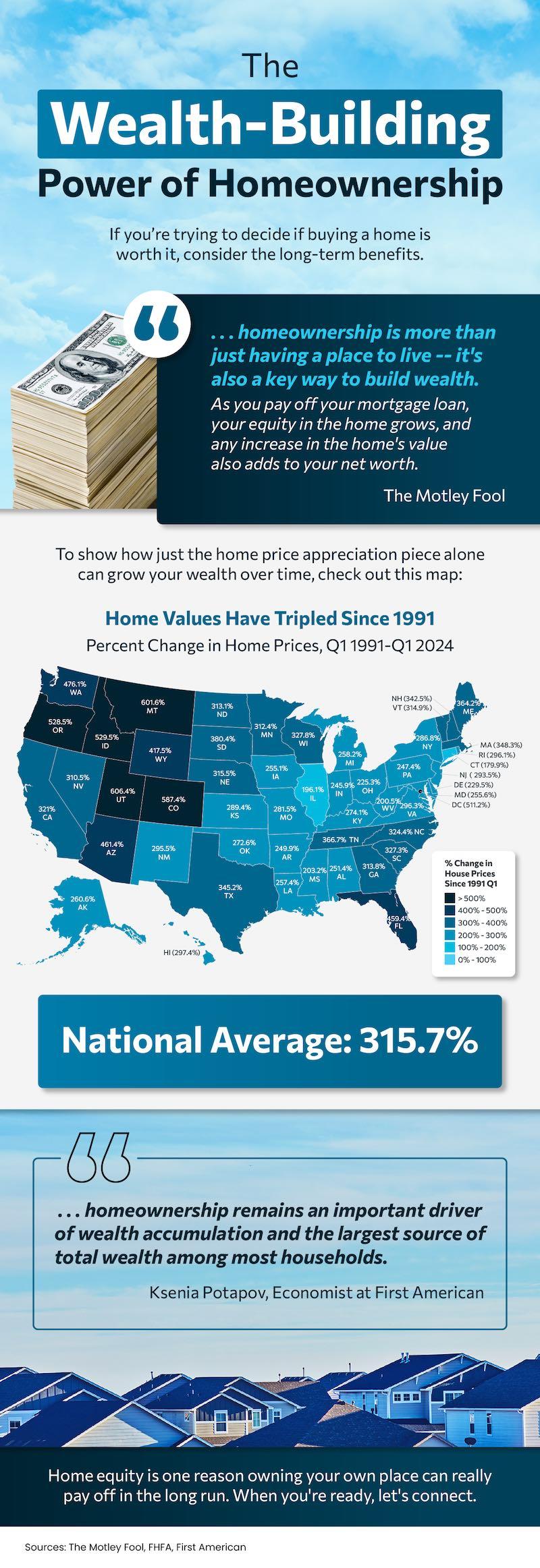

Some Highlights

- According to a recent poll from Gallup, real estate has been voted the best long-term investment for twelve straight years.

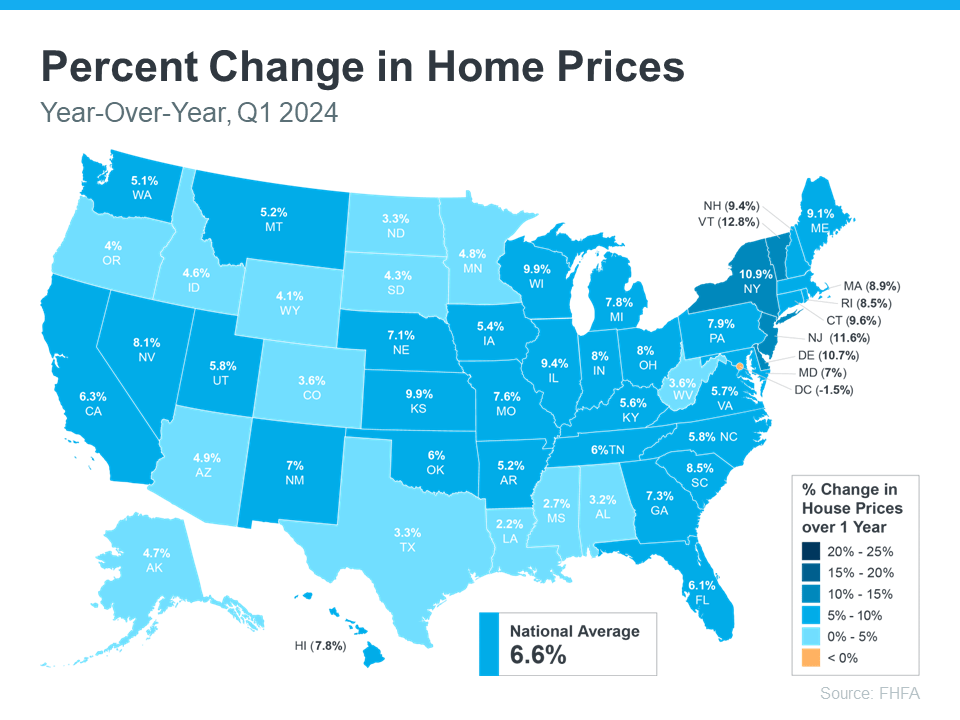

- That’s because a home is so much more just than a roof over your head. It’s also an asset that typically grows in value over time.

- If you’ve been debating if it makes more sense to rent or buy, connect with a real estate agent to talk about why homeownership can be a better bet in the long run.

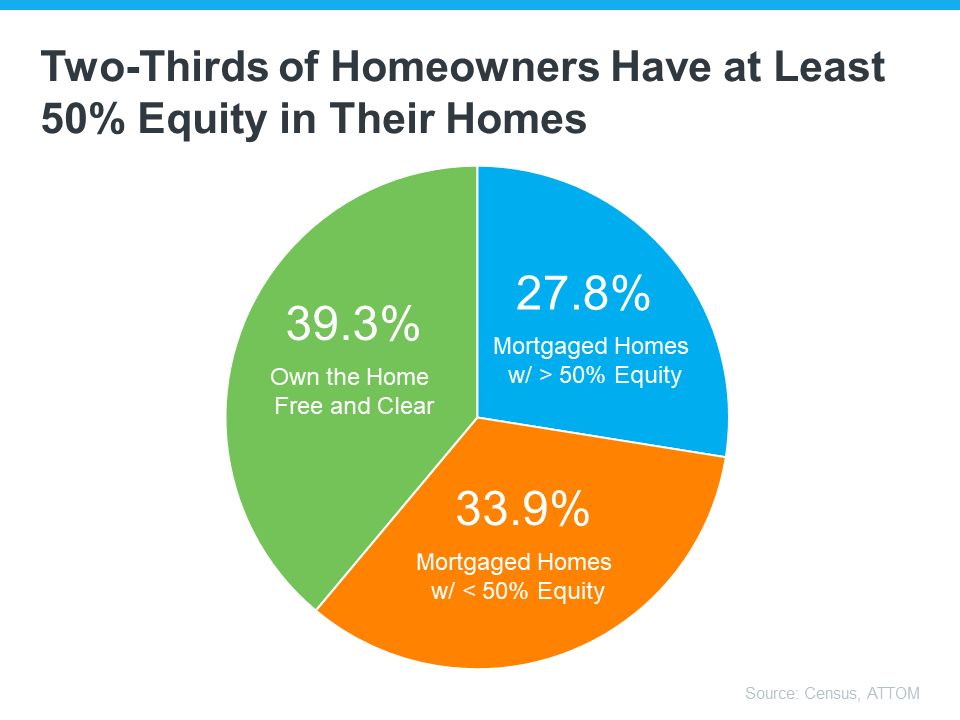

![The Wealth-Building Power of Homeownership [INFOGRAPHIC] Simplifying The Market](https://terceroagency.com/wp-content/uploads/2024/06/The-Wealthbuilding-Power-of-Homeownership-KCM-Share-original.png)