What Experts Project for Home Prices Over the Next 5 Years

If you're planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment. While you may have seen negative news over the past year about home prices, they’re doing far better than expected and are rising across the country. And data shows, experts forecast home prices will keep appreciating.

Experts Project Ongoing Appreciation

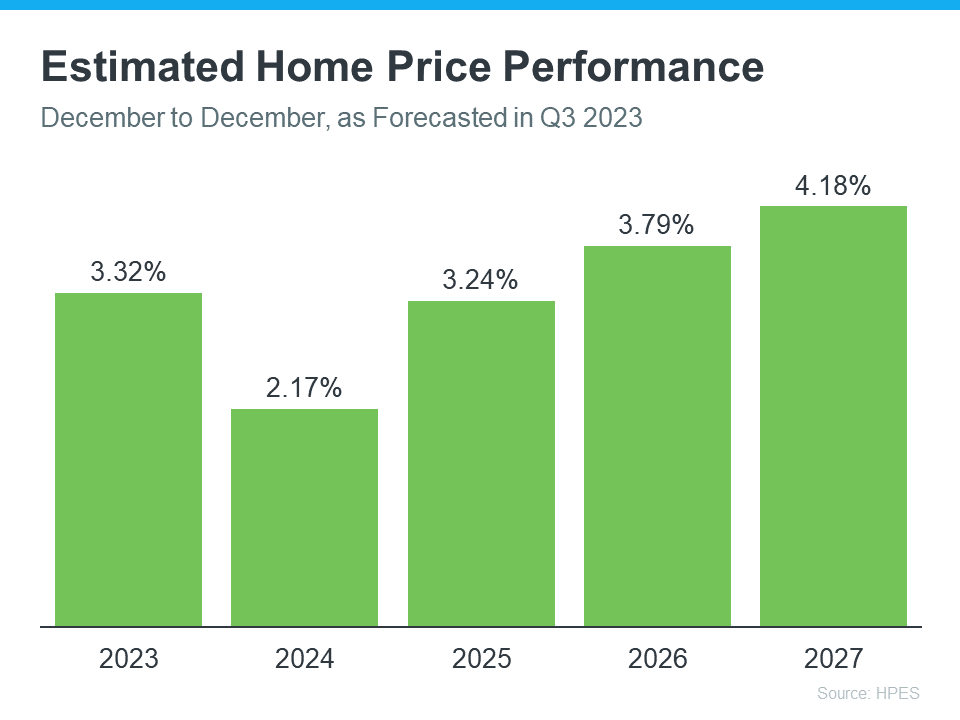

Pulsenomics polled over 100 economists, investment strategists, and housing market analysts in the latest quarterly Home Price Expectation Survey (HPES). The results show what the panelists project will happen with home prices over the next five years. Here are those expert forecasts saying home prices will go up every year through 2027 (see graph below): If you’re someone who was worried home prices would fall because of stories you’ve read online, here's the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

If you’re someone who was worried home prices would fall because of stories you’ve read online, here's the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

And while the projected increase in 2024 isn’t as large as 2023, it’s important to recognize home price appreciation is cumulative. In other words, if these experts are correct, after your home’s value rises by 3.32% this year, it’ll appreciate by another 2.17% next year. This is a good example of why owning a home is a choice that wins big over time.

What Does This Mean for You?

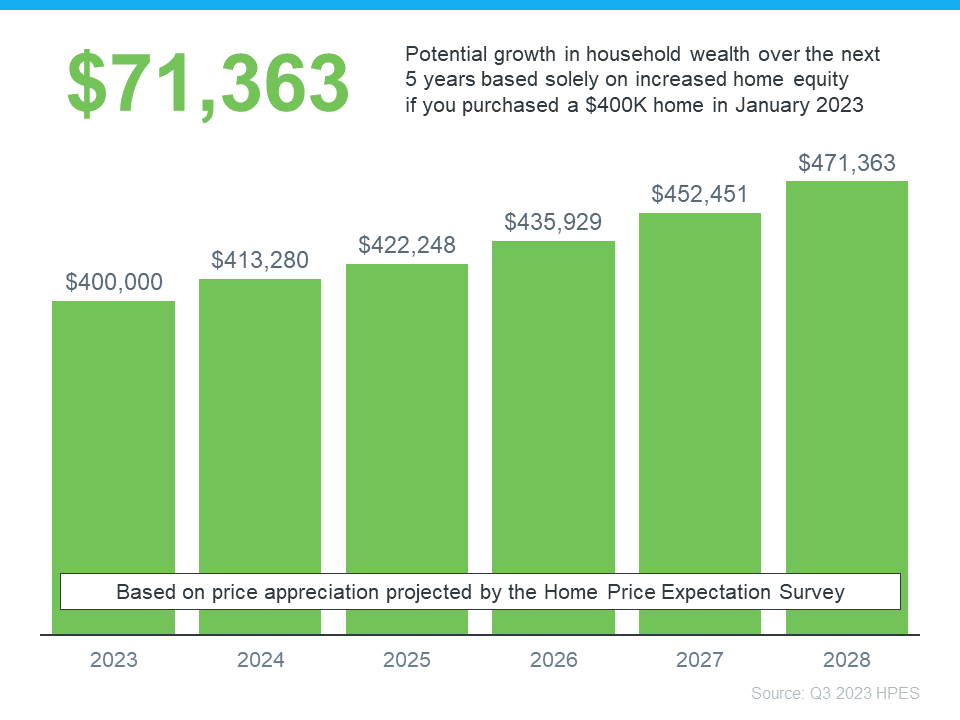

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. To see how a typical home's value could change in the next few years using the expert projections from the HPES, check out the graph below: In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

So, if you're thinking about whether buying a home is a good choice, remember how it can be a powerful way to grow your wealth in the long run.

Bottom Line

According to the experts, home prices are expected to grow over the next five years at a more normal pace. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) grow. Connect with a local real estate agent to start the homebuying process today.

Planning to Retire? Your Equity Can Help You Make a Move

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why.

Consider How Long You’ve Been in Your Home

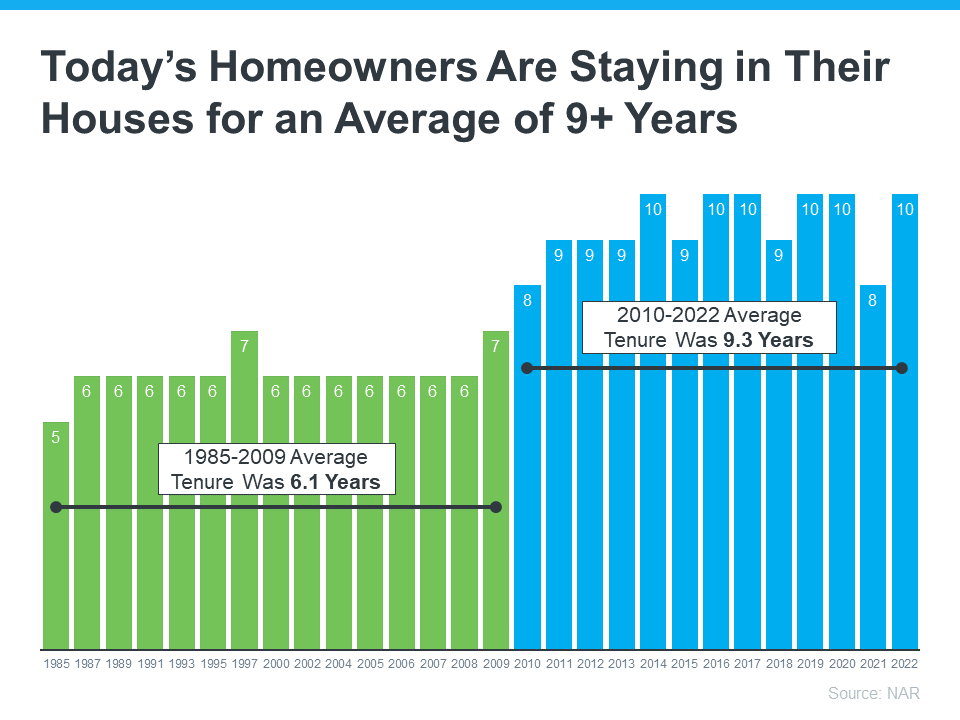

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to the National Association of Realtors (NAR), that number is higher today. Since 2010, the average home tenure is just over nine years (see graph below):

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

Consider the Equity You’ve Gained

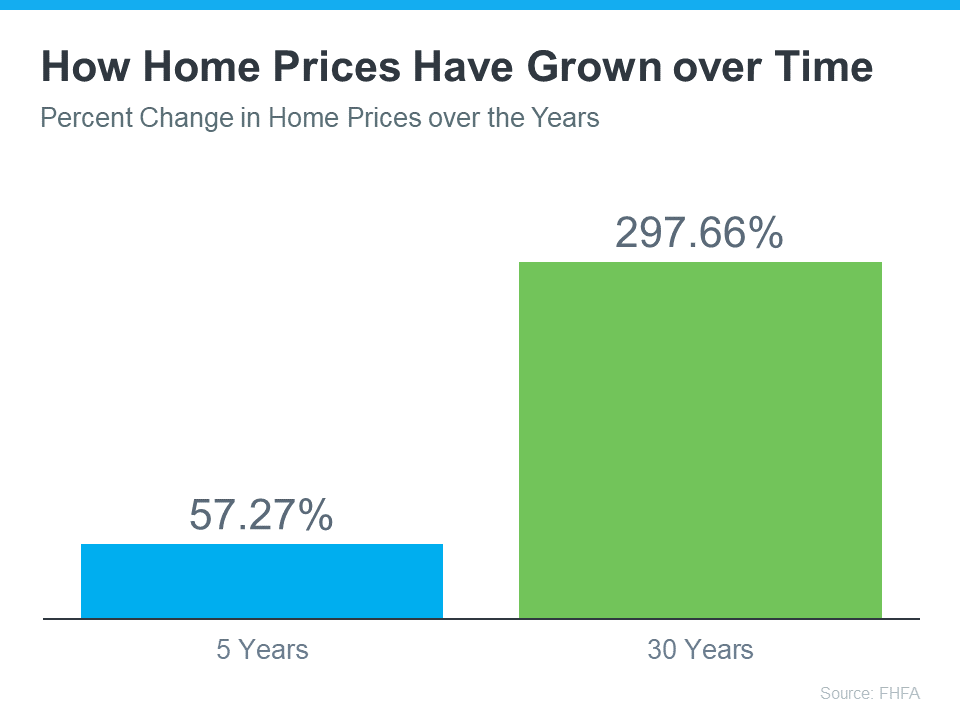

And, if you’ve been in your home for more than a few years, you’ve likely built-up substantial equity that can fuel your next move. That’s because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you’ve been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to friends or loved ones, that equity can help. Whatever your home goals are, a trusted real estate agent can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

Bottom Line

As you plan for your retirement, connect with a local real estate agent to find out how much equity you’ve built up over the years and plan how you can use it toward the purchase of a home that fits your changing needs.

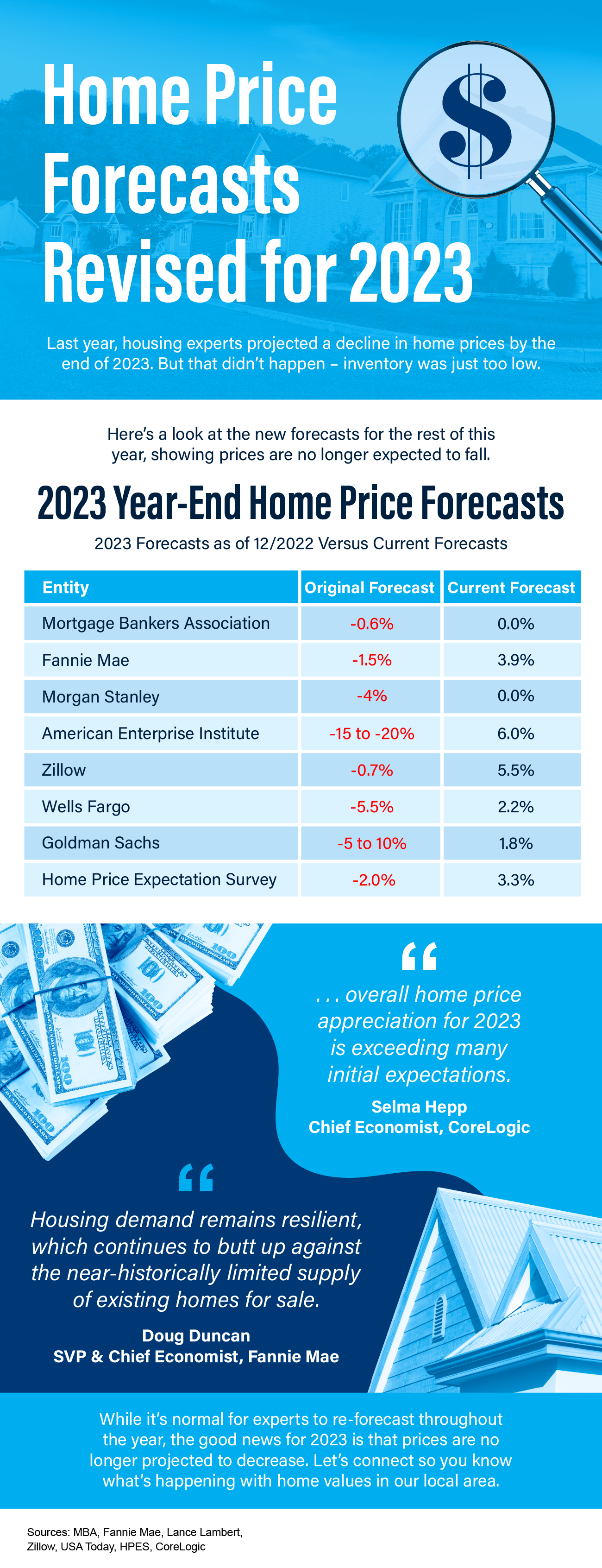

Home Price Forecasts Revised for 2023 [INFOGRAPHIC]

![Home Price Forecasts Revised for 2023 [INFOGRAPHIC] Simplifying The Market](https://terceroagency.com/wp-content/uploads/2023/09/Home-Price-Forecasts-Revised-for-2023-KCM-Share.png)

Some Highlights

- Last year, some housing experts projected a decline in home prices by the end of 2023. But that didn’t happen – inventory was just too low.

- While it’s normal for experts to re-forecast throughout the year, the good news for 2023 is that prices are no longer projected to decrease.

- Connect with your trusted real estate agent to find out what’s happening with home values in your local area.

Sources

- https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/mortgage-finance-forecast-dec-2022.pdf

- https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-aug-2023.pdf

- https://www.fanniemae.com/media/45801/display

- https://www.fanniemae.com/media/48726/display

- https://twitter.com/NewsLambert/status/1671900591113609216 (Morgan Stanley)

- https://twitter.com/NewsLambert/status/1671556169712672768 (AEI)

- https://www.zillow.com/research/data/

- https://www.zillow.com/research/housing-market-challenges-32923/

- https://ustoday.news/a-20-drop-in-house-prices-7-forecast-models-tend-to-crash-here-the-other-13-models-show-the-housing-market-in-2023/ (Wells Fargo)

- https://twitter.com/NewsLambert/status/1686959362563092480 (Wells Fargo)

- https://twitter.com/NewsLambert/status/1691799764466008217 (Goldman Sachs)

- https://pulsenomics.com/surveys/#home-price-expectations

- https://www.corelogic.com/intelligence/us-corelogic-sp-case-shiller-index-down-by-0-5-year-over-year-in-may-but-a-turning-point-may-be-ahead/

- https://view.e.fanniemae.com/?qs=dd7a875aaf273bf9cc0d451ff7cd4bec791f29b000f7916b3935d94770ed1f009af1072ee8400b8d3d40310113be33e6106c9aea71d7b22fbb87ad26bbcfe90630f1ef8f04bd2f7b7576e1b494263bf85f1ae4e4ba224216

Get Ready for Smaller, More Affordable Homes

Have you been trying to buy a home, but higher mortgage rates and home prices are limiting your options? If so, here’s some good news – based on what Ali Wolf, Chief Economist at Zonda, has to say – smaller, more affordable homes are on the way:

“Buyers should expect that over the next 12 to 24 months there will be a notable increase in the number of entry-level homes available.”

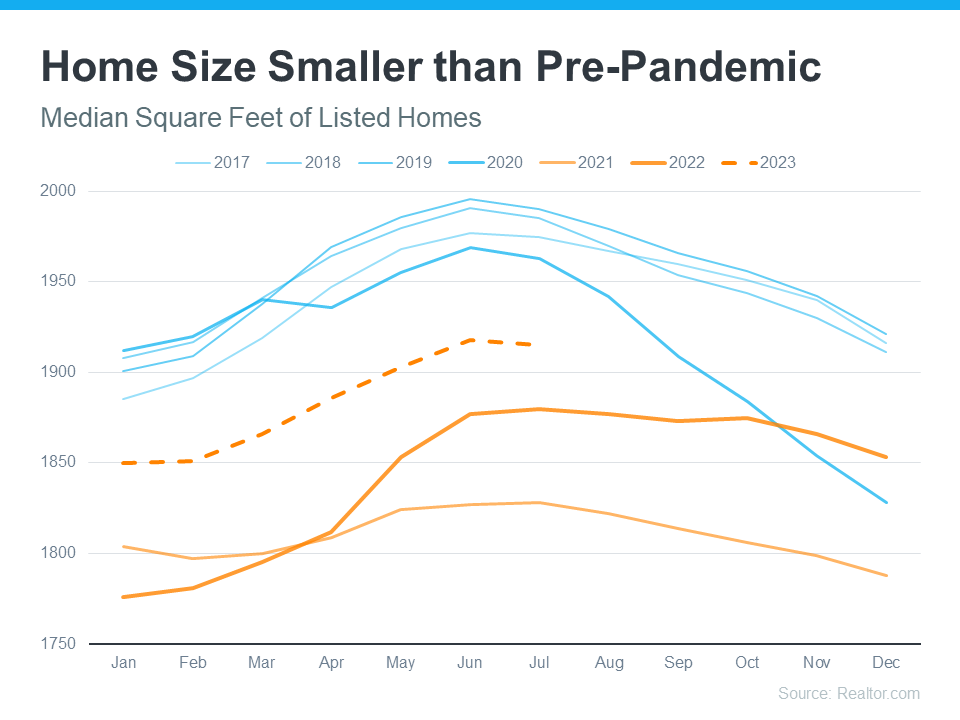

In some ways, smaller homes are already here. When the pandemic hit, the meaning of home changed. People needed the space their home provided not only as a place to live, but as a place to work, go to school, exercise, and more. Those who had that space were more likely to keep it. And those that didn’t were in a position where they were trying to sell their smaller house to move up to a larger one. That meant the homes coming to the market during the pandemic were smaller than those on the market before the pandemic – and that trend continues today (see graph below): This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

That seasonality means, based on historical trends and the fact that fall is now approaching, we can expect smaller, more affordable homes to come to the market throughout the rest of the year.

That’s great news because, as Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), states, the need for these types of homes has gone up recently:

“. . . as interest rates increased in 2022, and housing affordability worsened, the demand for home size has trended lower.”

What Does This Mean for You?

The seasonal trend of smaller homes coming to the market in the later months of the year, coupled with builders bringing smaller, more affordable newly built homes to the market right now, is good news – especially if you’re finding it difficult to afford a home. Mikaela Arroyo, Director of the New Home Trends Institute at John Burns Real Estate Consulting, says this about a potential increase in the availability of smaller homes:

“It’s not solving the affordability crisis, but it is creating opportunities for people to be able to afford an entry-level home in an area.”

Bottom Line

If a smaller, more affordable home sounds appealing to you, good news – they’re coming. To keep up with what’s available in your area, connect with a local real estate agent.

Contact Us

PHONE NUMBER

(505) 557-3969

ADDRESS

Keller Williams Realty 130 Lincoln Avenue, Suite K Santa Fe, New Mexico 87501

EMAIL ADDRESS

santafe@terceroagency.com

Sign up for our Santa Fe real estate E-mail reports which include the newest listings, closed sales, LIVE Santa Fe cam, local events, and much more…

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact

© 2010 - 2024 Tercero Agency. All Rights Reserved.