Some Highlights

Thinking about making a move in 2025 and wondering what you can expect? Here’s what expert forecasts say lies ahead.

- Mortgage rates will come down slightly. More homes will sell. And prices will rise more moderately.

- Connect with a local agent to discuss what these forecasts mean for your move and what to expect from your local market in 2025.

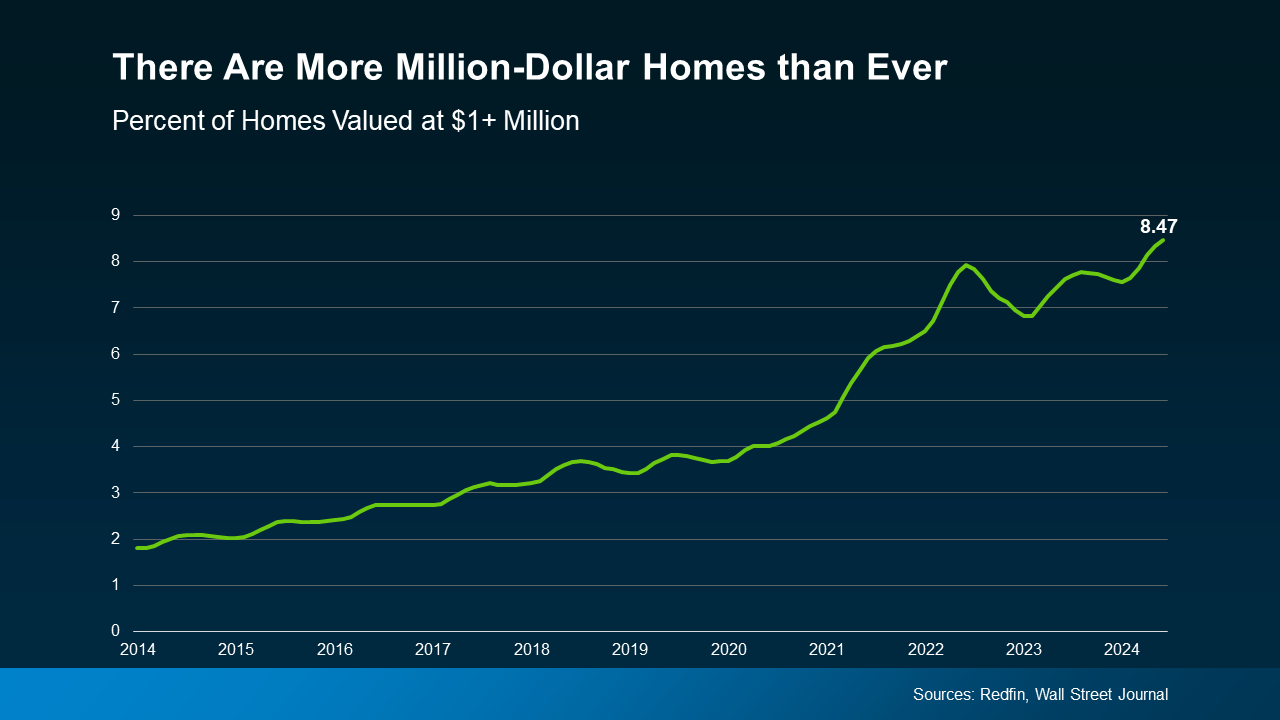

That means, if this is your desired price range, you have options to choose from, each with different features and styles.

That means, if this is your desired price range, you have options to choose from, each with different features and styles.

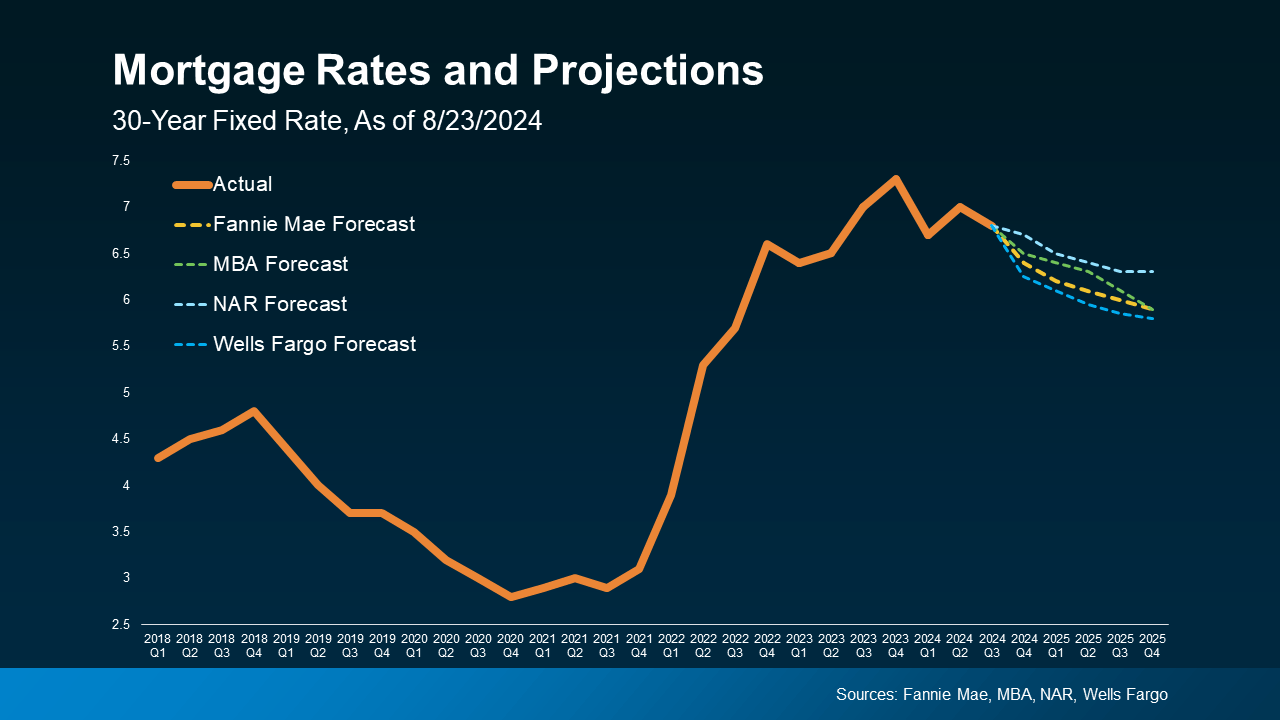

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

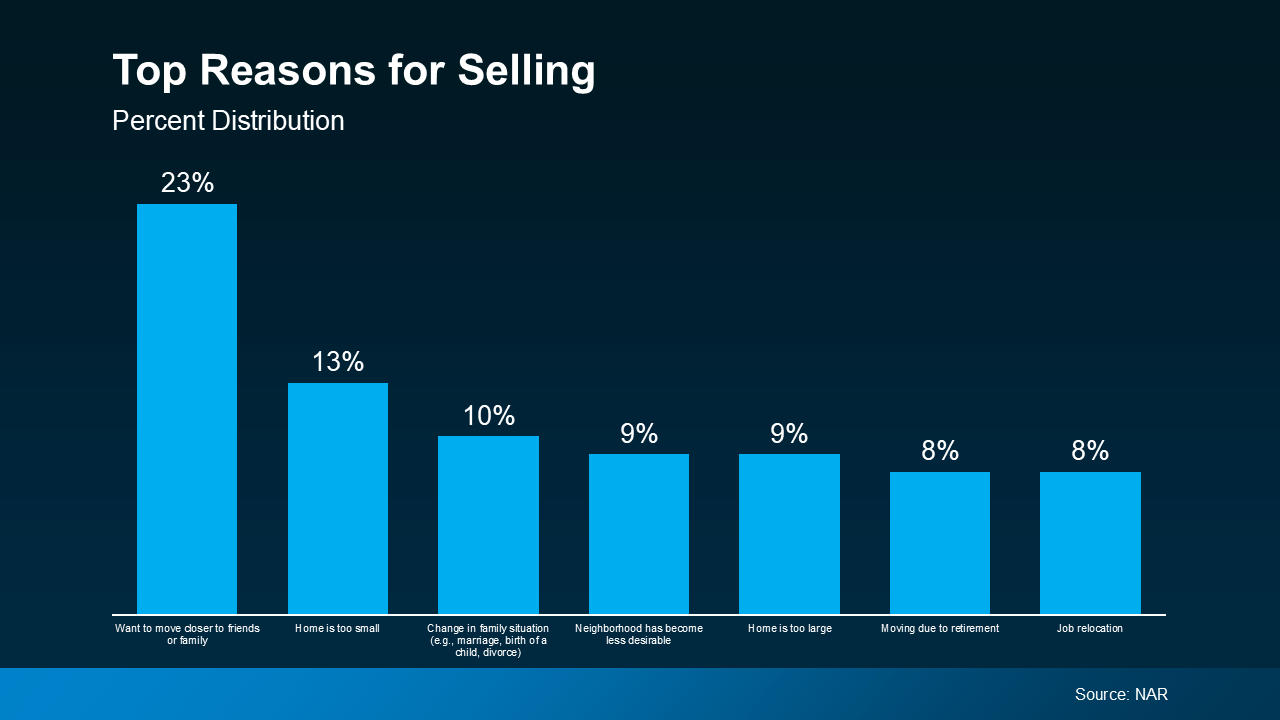

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

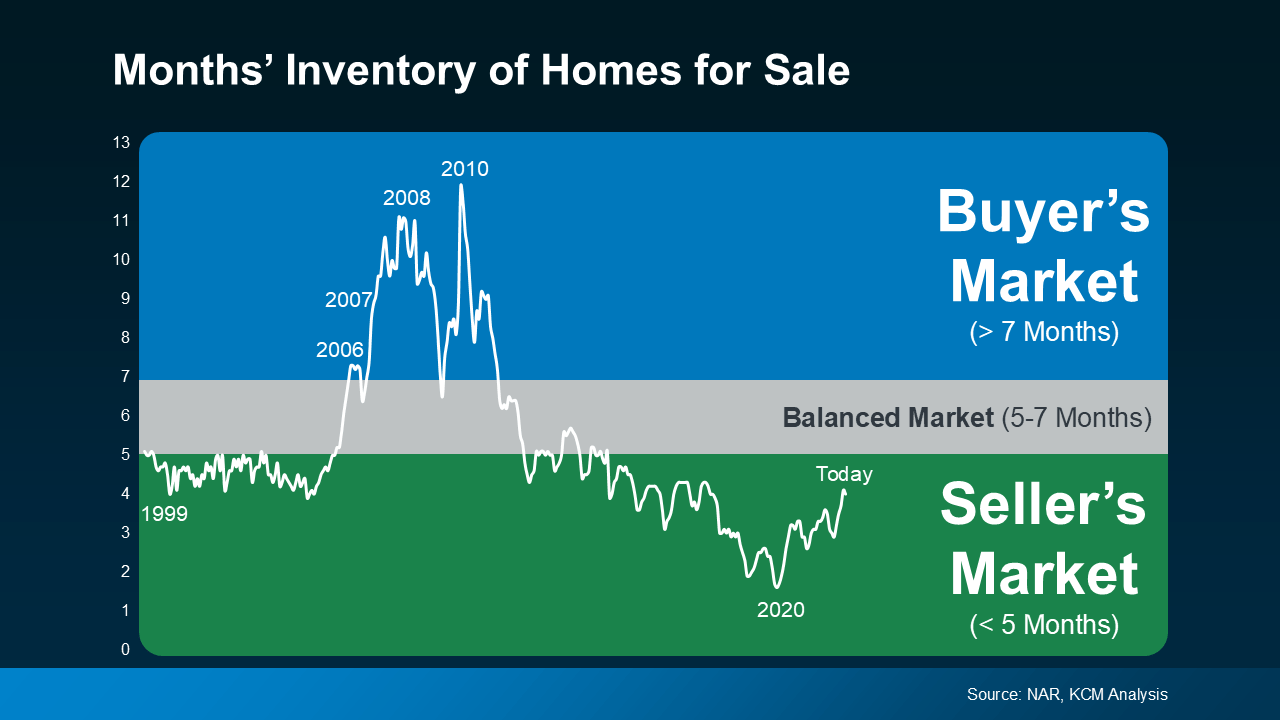

For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says:

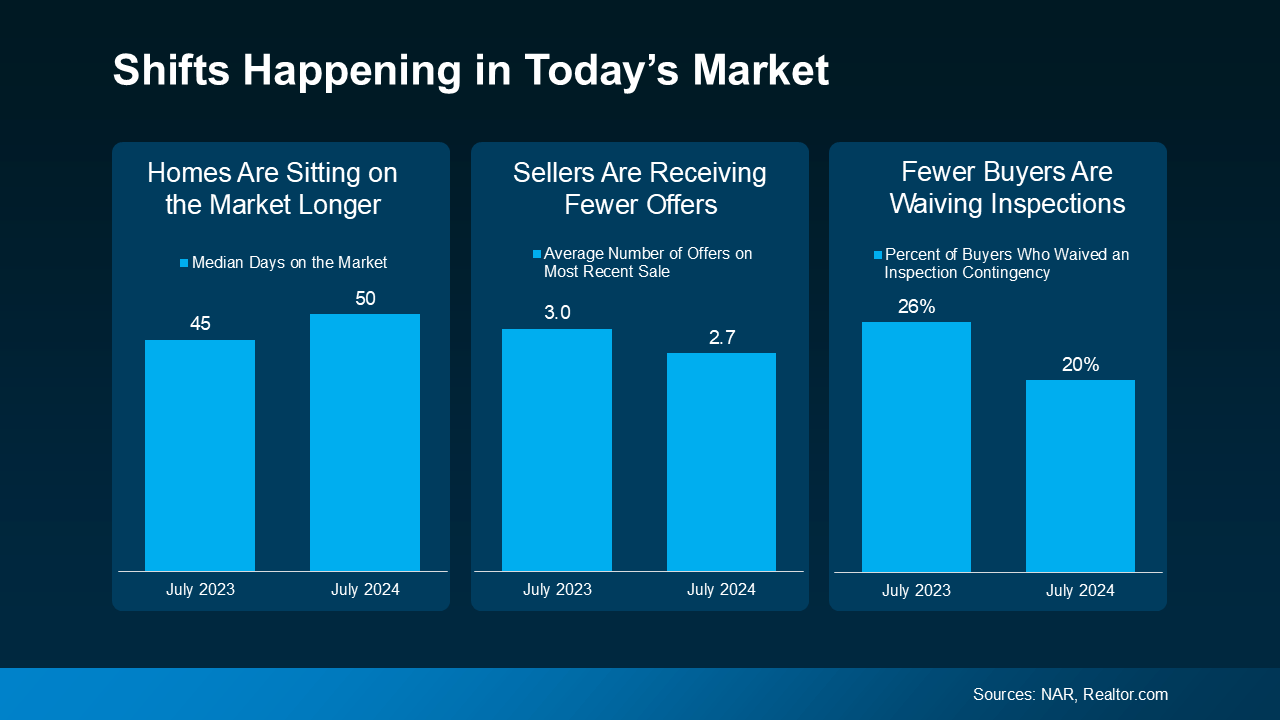

For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says: Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.

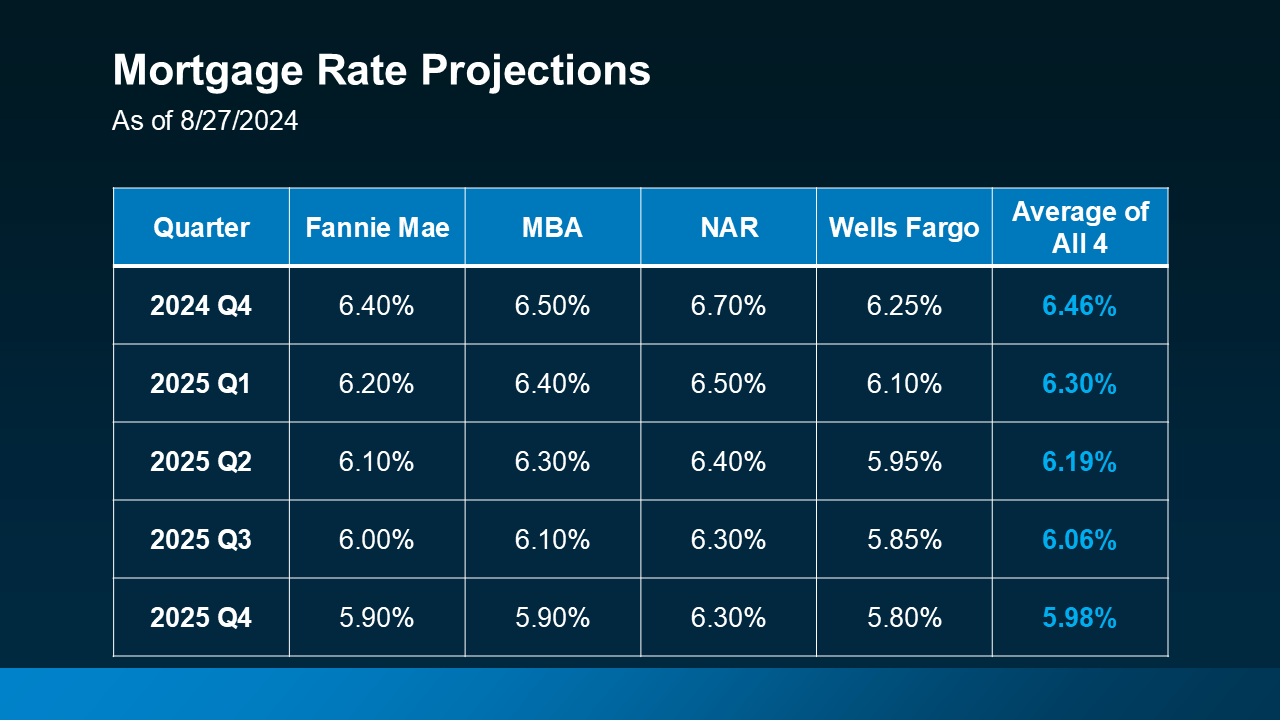

Mortgage rates are projected to come down because continued easing of inflation and a slight rise in unemployment rates are key signs of a strong but slowing economy. And many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which tends to lead to lower mortgage rates. As Morgan Stanley says:

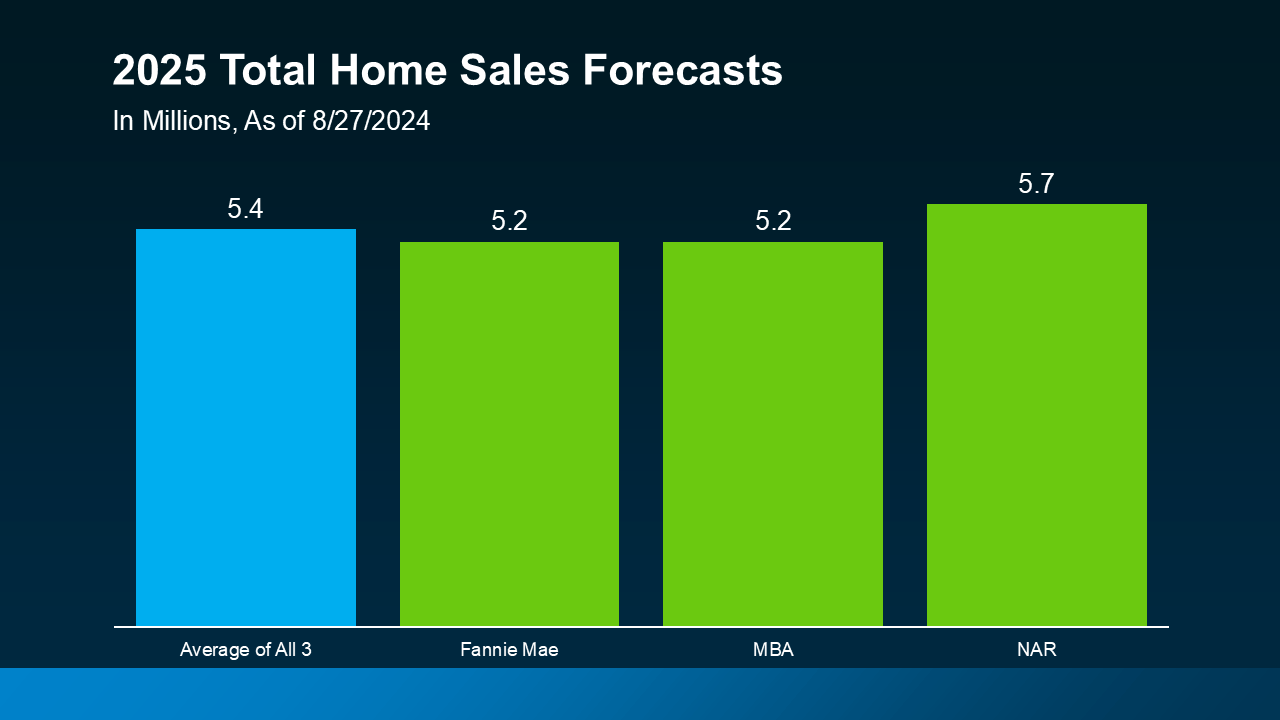

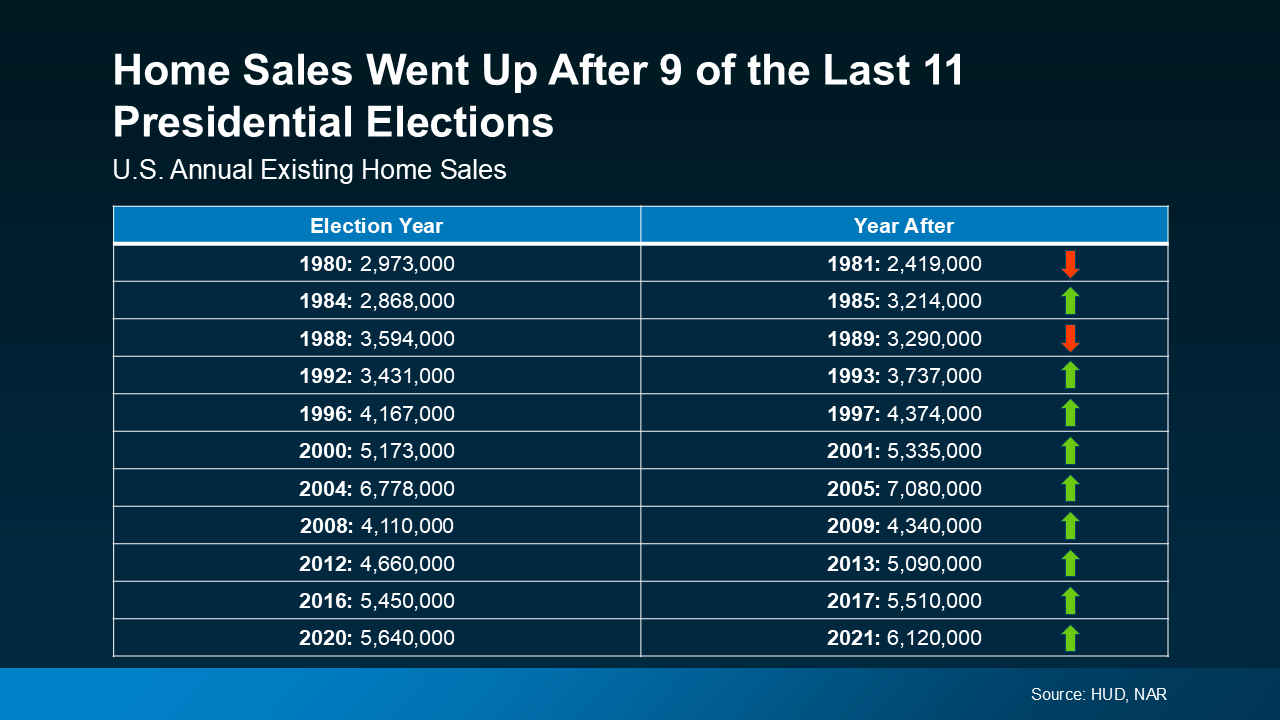

Mortgage rates are projected to come down because continued easing of inflation and a slight rise in unemployment rates are key signs of a strong but slowing economy. And many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which tends to lead to lower mortgage rates. As Morgan Stanley says: That would represent a modest uptick from the lower sales numbers in 2023 and 2024. For reference, about 4.8 million total homes were sold in 2023, and expectations are for around 4.5 million homes to sell this year.

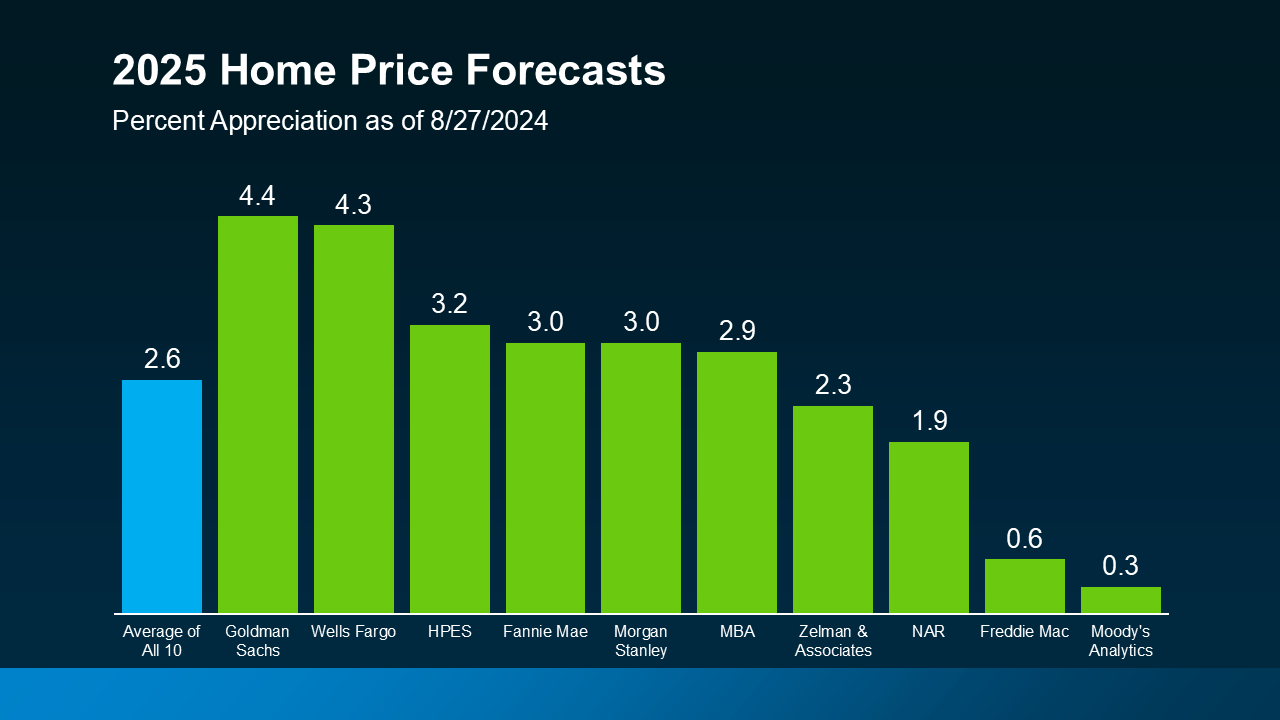

That would represent a modest uptick from the lower sales numbers in 2023 and 2024. For reference, about 4.8 million total homes were sold in 2023, and expectations are for around 4.5 million homes to sell this year. On average, experts forecast home prices will rise nationally by about 2.6% next year. But as you can see, there’s a range of opinions on how much prices will climb. Experts agree, however, that home prices will continue to increase moderately next year at a slower, more normal rate. But keep in mind, prices will always vary by local market.

On average, experts forecast home prices will rise nationally by about 2.6% next year. But as you can see, there’s a range of opinions on how much prices will climb. Experts agree, however, that home prices will continue to increase moderately next year at a slower, more normal rate. But keep in mind, prices will always vary by local market.

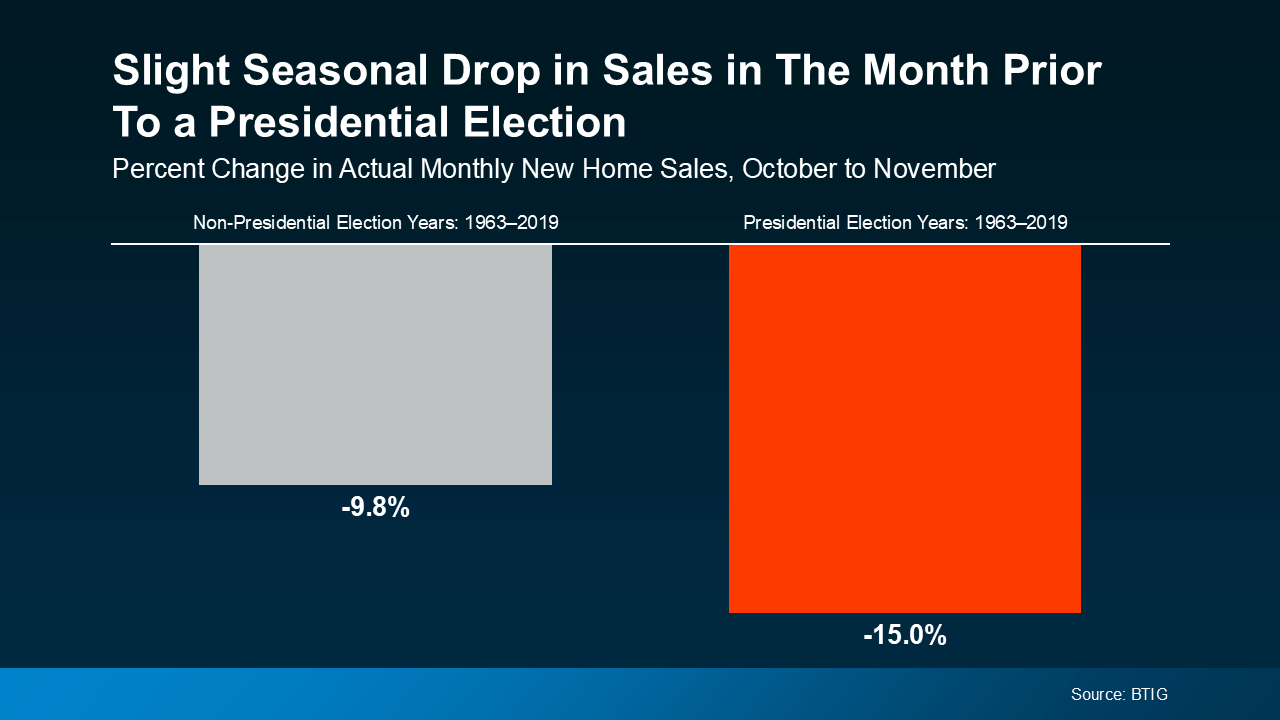

Some consumers will simply wait it out before they make their purchase decision.

Some consumers will simply wait it out before they make their purchase decision. Home Prices

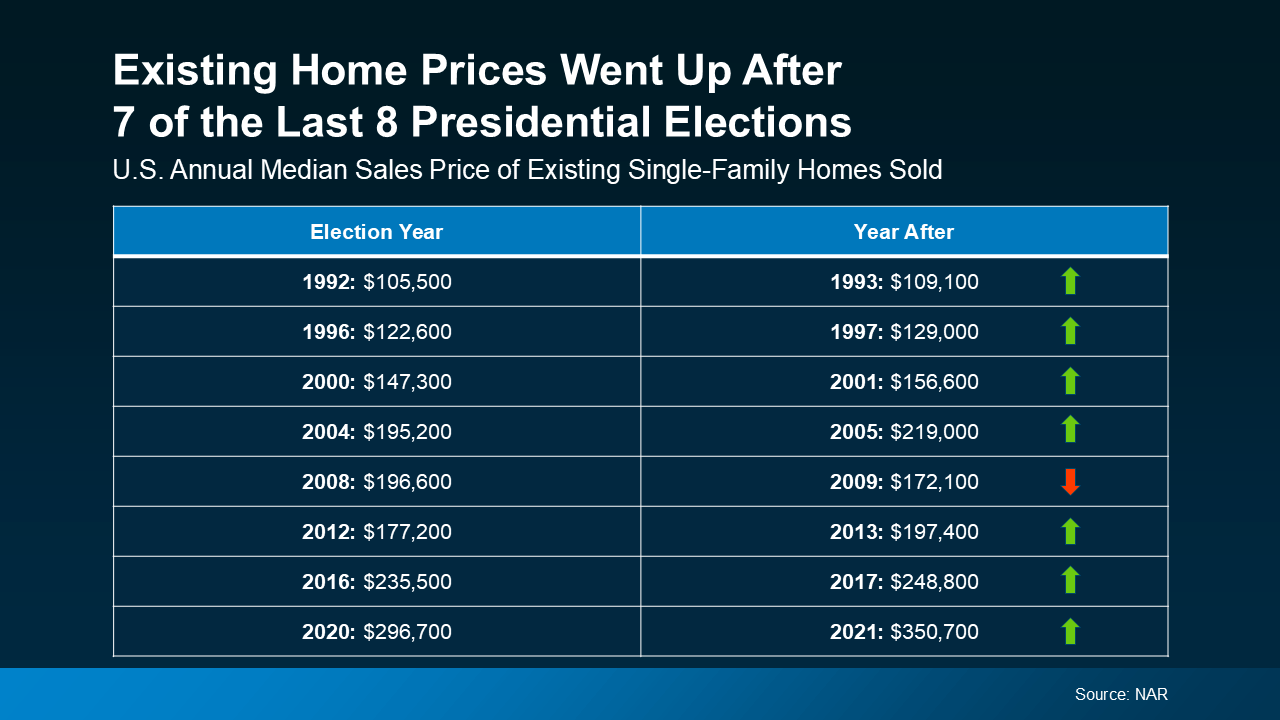

Home Prices The one outlier was from 2008 to 2009, which was during the height of the housing market crash. That was certainly not a typical year. Today’s market, however, is much more resilient. And while prices are moderating nationally, they aren’t on an overall decline.

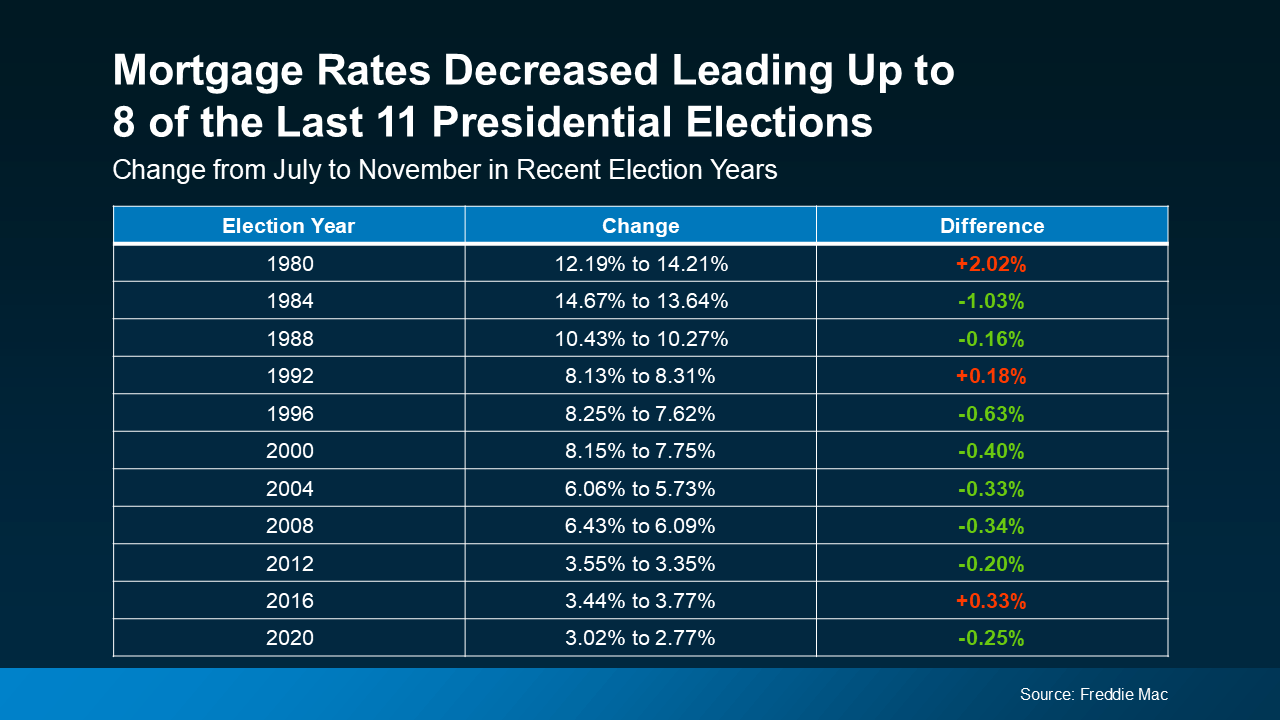

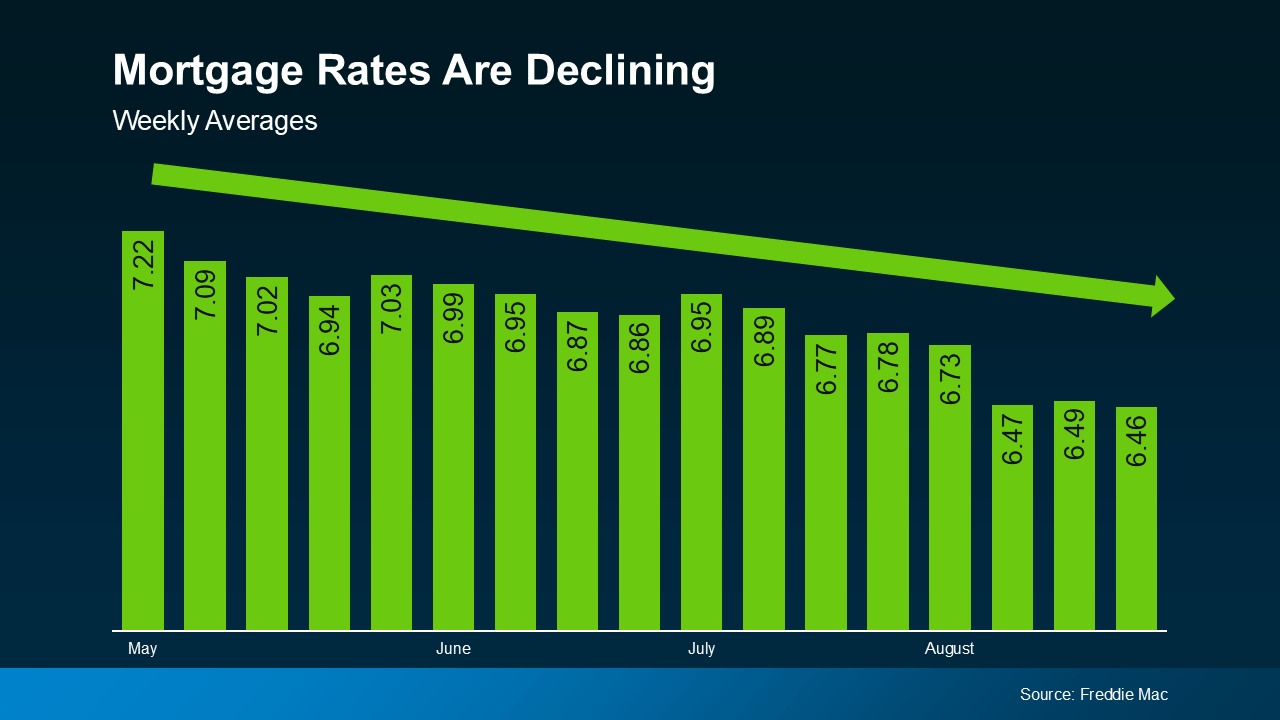

The one outlier was from 2008 to 2009, which was during the height of the housing market crash. That was certainly not a typical year. Today’s market, however, is much more resilient. And while prices are moderating nationally, they aren’t on an overall decline. And this year, we’ve already started to see that happen. Most experts also forecast mortgage rates will ease slightly throughout the rest of 2024. If that happens – and all signs right now indicate it should – this year will continue to follow the trend of declining rates. So, if you’re looking to buy a home in the coming months, this could be great news for your purchasing power.

And this year, we’ve already started to see that happen. Most experts also forecast mortgage rates will ease slightly throughout the rest of 2024. If that happens – and all signs right now indicate it should – this year will continue to follow the trend of declining rates. So, if you’re looking to buy a home in the coming months, this could be great news for your purchasing power.

And if you’re thinking about buying a home, that may leave you wondering: how much lower are they going to go? Here’s some information that can help you know what to expect.

And if you’re thinking about buying a home, that may leave you wondering: how much lower are they going to go? Here’s some information that can help you know what to expect.